Also in this letter:

■ Panel proposes huge fines for violating India’s data law

■ SoftBank says India digital demand strong, will keep investing

■ ETtech Deals Digest: the biggest deals this week

CCI suspends Amazon-Future deal, fines US firm Rs 200 crore

India’s antitrust body on Friday suspended Amazon’s 2019 deal with Future Group after reviewing allegations that the company had concealed information while seeking regulatory approval. The Competition Commission of India (CCI) also fined Amazon Rs 200 crore.

Context: The CCI order was based on an application filed in March by Future Group subsidiary FCPL, which accused Amazon of concealing facts and flouting India’s foreign direct investment and foreign exchange laws while seeking the watchdog’s approval in 2019 for its investment into FCPL. The order comes two weeks after the Supreme Court had given Amazon two weeks to file its response in the case.

Significance: The CCI’s unprecedented step could have far-reaching consequences for Amazon’s legal battles with now-estranged partner Future. For months, Amazon had successfully used the terms of its $200 million investment in Future in 2019 to block the company’s attempt to sell its retail assets to Reliance Industries for $3.4 billion.

The order: In a 57-page order, the CCI said it considers “it necessary to examine the combination (deal) afresh,” adding that its approval from 2019 “shall remain in abeyance” until then.

The order said that Amazon had “suppressed the actual scope” of the deal and had made “false and incorrect statements” while seeking approvals.

Amazon’s plea: On Monday, Amazon India told the CCI that it did not hide any facts related to its deal with Future Group and that its investment in FCPL was compliant with foreign investment laws, people aware of the development said. It also warned India’s antitrust body that revoking its 2019 deal would send a negative signal to foreign investors and allow local retail behemoth Reliance to “further restrict competition”.

Timeline: Amazon, Reliance and the fight for Future

House panel recommends fines of up to 4% of global turnover for data law violations

The joint parliamentary committee on the personal data protection bill has recommended steep fines – up to Rs 15 crore or 4% of global turnover, whichever is higher – for serious violations of the proposed law. Less serious violations will attract a fine of up to Rs 5 crore or 2% of global turnover, whichever is higher.

Catch up quick: We reported on Thursday that the JPC had submitted its final report on the Data Protection Bill in Parliament. The report said, among other things, that India’s data protection law must encompass both personal and non-personal data and treat social media platforms as content publishers.

Significance: The provision on penalties, if it becomes law, will pose a strong incentive for social media giants and top tech companies such as Facebook, Instagram, Google, Amazon and Apple to abide by India’s proposed data protection rules.

Violations: The top penalty would be imposed for, among other things, violations in processing the personal data of users and children; failing to adhere to security safeguards; and transferring personal data outside India.

The lesser penalty would be for things like failing to act promptly on a data security breach, failing to register with the proposed data protection authority, failing to undertake a data protection impact assessment or conduct a data audit; or failing to appoint a data protection officer.

Out then in: The panel had not included the recommendation in its draft report, leaving it up to the union government to decide on penalties. But it reintroduced the recommendation in the final version, which it submitted in Parliament on Thursday.

In its draft report of November, the panel had said, “In the committee’s view, such quantification [of fines] may not be feasible as there are no clear mechanisms to quantify the ‘worldwide turnover’ of the company and that too along with its group entities. Also keeping in view the rapidly changing dynamics of the evolving digital technologies, the committee feels that it would be prudent to enable the government to quantify the penalties.”

The penalties were a part of the 2019 version of India’s Personal Data Protection Bill, and exist in a similar form in the European Union’s General Data Protection Regulation (GDPR).

Heated debate: There have been heated discussions among members of the panel on the proposal to drop the clauses, before committee chair and senior BJP leader PP Chaudhary said the penalties needed to be restored. Opposition MPs registered their objections.

Bill has “fundamentally changed”: Meanwhile, the Internet and Mobile Association of India (IAMAI) said the latest version of the bill was fundamentally different from the draft that was released “after the widest possible consultations” in 2019.

The industry body said its members were currently evaluating the JPC report, adding, “Prima facie it seems that the 2019 draft… has changed fundamentally, including the title of the bill from Personal Data Protection Bill to Data Protection Bill.”

It said other changes from the 2019 draft, such as the recommendations that social media intermediaries be treated as publishers in certain circumstances, and a few aspects of data localisation norms, “change the original structure of the bill substantially”.

“The report currently encompasses non-personal data within the personal data protection bill which is contrary to the recommendations of the expert committee appointed by Meity to develop a framework for non-personal data governance,” IAMAI said.

Also Read: Decoding the Data Protection Bill

SoftBank says India digital demand strong, will keep investing

SoftBank Group Corp. will continue to invest in India’s digital companies, undeterred by Patym’s recent plunge.

The Japanese firm that has so far invested a reported $14 billion in India expects the digital market to keep booming on strong retail demand, according to Manoj Kohli, country head of SoftBank India.

Quote: “There’s no market in the world that can massify tech as India is doing,” Kohli told Bloomberg. “That’s why our founder Masa believes in the Indian market and would invest in Indian growth,” he said, referring to Masayoshi Son.

SoftBank founder and CEO Masayoshi Son said the Japanese firm is the biggest foreign investor in India, we reported earlier this month.

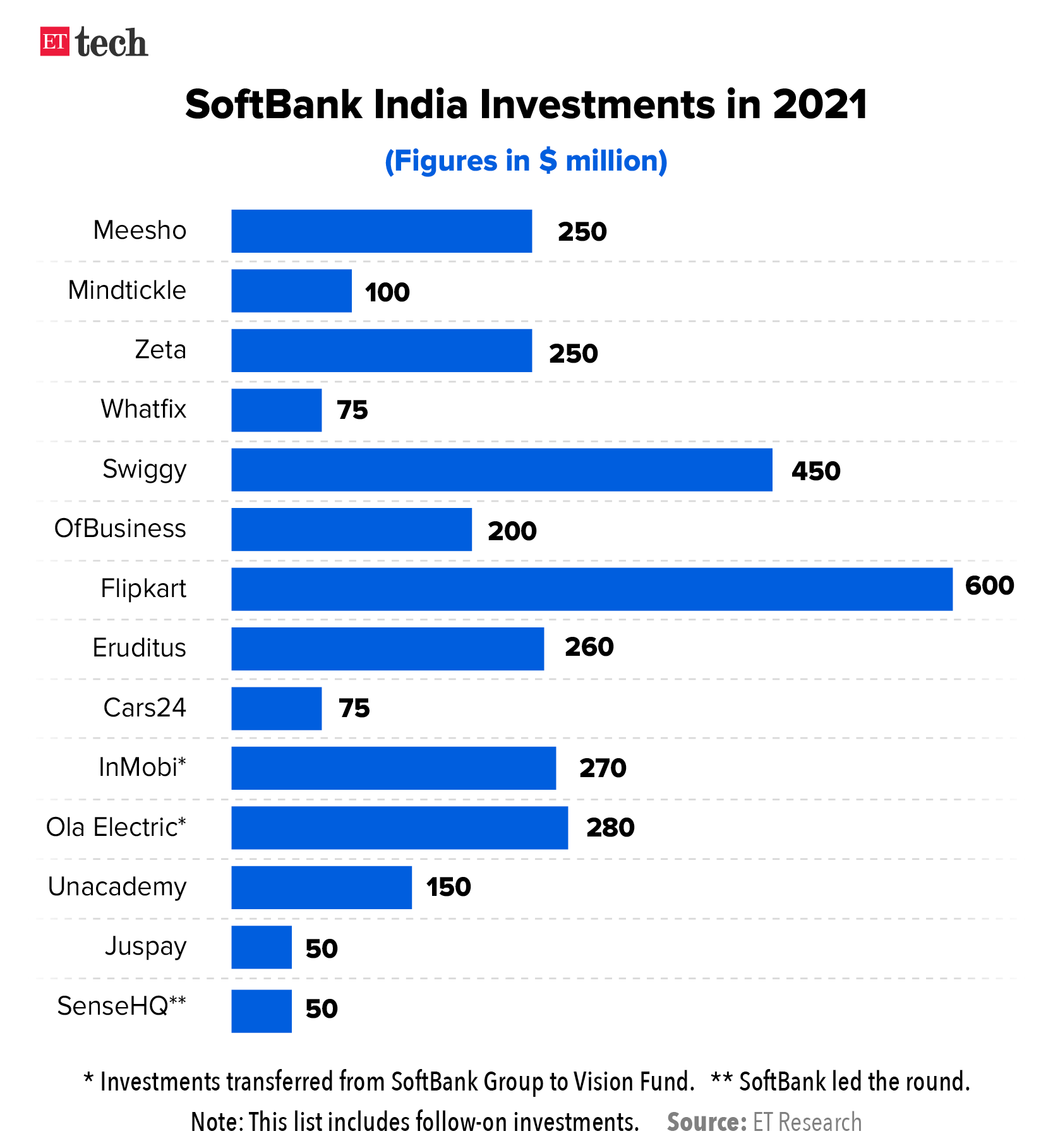

SoftBank is among the most bullish investors in Indian startups having backed large startups like Paytm, Ola, Grofers, Oyo and others. In 2021, the company re-invested in ecommerce major Flipkart besides birthing new unicorns like Zeta, Meesho, OfBusiness, among others.

Paytm’s slide continues: Shares in SoftBank-backed fintech giant Paytm plunged to a three-week low on Thursday after a lock-up period for anchor investors expired, following its $2.5 billion share sale. For Kohli, this is a short-term issue as India’s digital markets get tested for the first time.

- “I am sure in the long-term it’ll be a very large digital market,” he said.

SoftBank bets on Indian fintech again: Payments technology startup Juspay raised $60 million in a funding round led by SoftBank Vision Fund II, we reported last week.

Cred users paid Rs 52,000 crore with credit cards for shopping in 2021

Cred users spent a total of Rs 52,000 crore through credit cards on shopping in 2021, with the festive season clocking the highest expenditure, according to a report put out by the credit cards-focused fintech platform.

October recorded the highest expenditure on shopping, with Rs 7,535 crore being spent, the report titled Cred Insights stated.

Quote: “Another interesting trend on shopping emerged after the restrictions were eased. The spending increased gradually—July (Rs 4,758 crore), August (Rs 6,833 crore) and September (Rs 5,926 crore) compared to a combined Rs 7,624 crore in June and May.”

Apart from shopping, digital payments and mobile wallets were the top categories for Indian credit card holders.

- June-October 2021 saw an increase in adoption of digital payments and wallets as more individuals opted for paying rent and education fees via credit.

- Similarly, credit card spending on e-commerce shopping soared during January to April, and August to October during the festive season.

- Expenditure on food and utility bills remained consistent, but spending on food and beverages spiked after lockdown restrictions were eased in the latter half of the year.

By the numbers: Credit card expenditure on travel stood at Rs 1,103.11 crore in September—higher than any month in 2021. In October, that figure was Rs 1,091 crore.

In comparison, Cred users spent a total of Rs 675 crore in the months of May and June, but an uptick was seen in July—to Rs 602.26 crore—as restrictions were eased in the aftermath of the second wave of the pandemic.

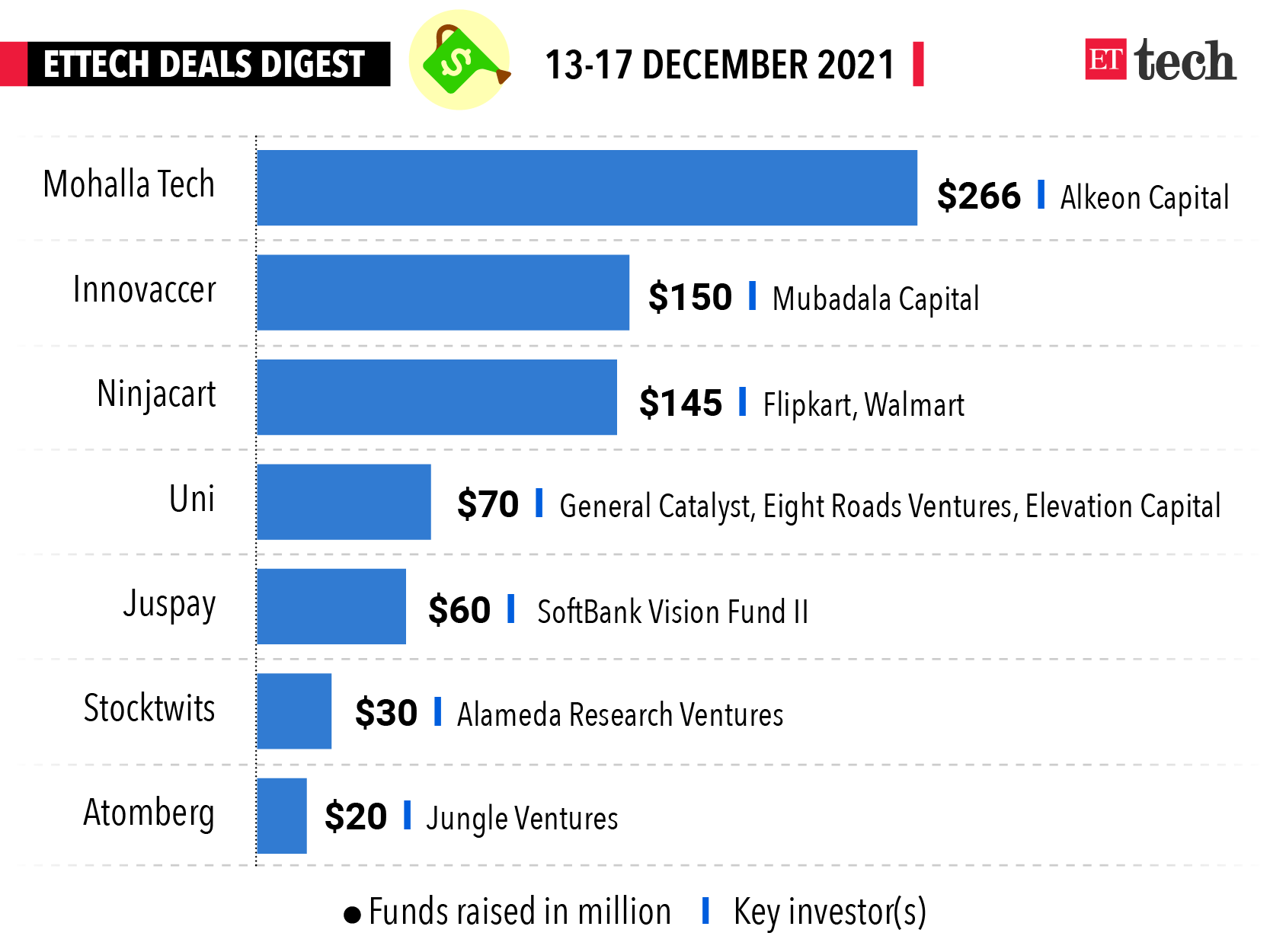

ETtech Deals digest

Here’s a quick look at the top funding deals of the week.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.