Amazon has acquired the startup in an all-cash deal, a person aware of the matter said. This is the first inorganic bet that Amazon is taking on the so-called social commerce space where sellers use platforms like Whatsapp and Facebook to sell their wares.

Amazon and Glowroad confirmed the development to ET.

“Amazon continues to explore new ways to digitise India and delight customers, micro- entrepreneurs and sellers and bringing Glowroad onboard is a key step in this direction. Together with Glowroad, Amazon will help accelerate entrepreneurship among millions of creators, homemakers, students, and small sellers from across the country…,” an Amazon spokesperson said in an emailed response.

Post the deal, Glowroad’s team of around 170 employees will join Amazon and the entity will continue to be run as an independent unit for now.

Kunal Sinha, cofounder of Glowroad, said, “As we are at the early stage, we look forward to working with Amazon to make the online shopping experience more convenient and trusted for new-to-e-commerce customers, and unlocking greater value for sellers and resellers,” he said.

Discover the stories of your interest

As per startup data platform, Tracxn Glowroad has raised a total funding of little over $31 million since its inception in 2017.

Sinha, Sonal Verma, Shekhar Sahu, Nitesh Pant and Nilesh Padariya are its cofounders. Together, the founder group holds close to 50% in the company with Verma and Sinha holding a relatively larger chunk of stake in the firm among founders. Accel being its largest institutional backer at about 19% stake, according to Tracxn data.

The company had last raised an equity round in 2020, when it picked up $7 million from its existing investors Accel and Vertex. A year before that,

it had racked up $10 million when China’s CDH led its funding round.

In 2019, Amazon Spark, which was the ecommerce behemoth’s social shopping experiment in the US, was shut down after two years of being operational. Known to be an Instagram-like platform with a shoppable feed, the company was tapping influencers for this business. Similarly, in India, Amazon took the call to phase out Spark

after launching it here in December 2018.

Glowroad, focuses on tier II and tier III markets through resellers who are typically housewives, temporary workers, or even students. “The idea is to pitch to the resellers that this is an earn-from-home business. They use WhatsApp groups to then talk and promote the products there and sell,” a person aware of Glowroad’s model said.

The company’s website says if a reseller sells 100 products a month then he or she can earn around Rs 20,000 per month. While typically resellers look for bulk purchases, Glowroad allows single purchases of items on the platform. The startup is present in about 20,000 pincodes, and as per the company’s website, it has a presence in 2,000 cities with over six million resellers.

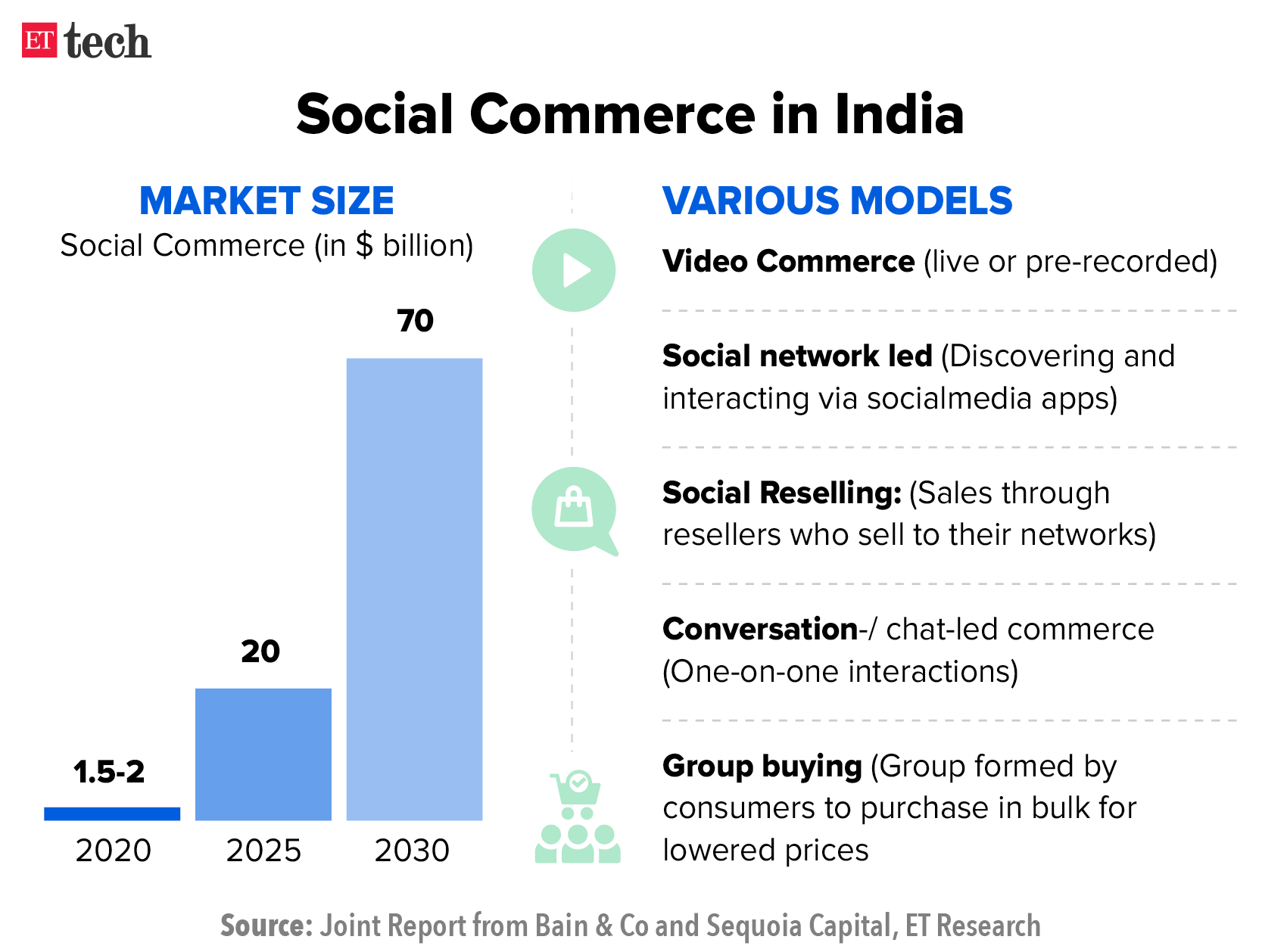

Amazon’s interest in social commerce and Glowroad comes at a time when etailers are looking to widen their customer base outside of the top 10-12 cities. Social commerce platforms see categories like fashion, home and kitchen and other segments drive a large volume of overall sales through the reseller network.

Besides Meesho, Flipkart’s Shopsy, the social commerce segment which is largely driven by price conscious customers, saw the entry of foreign ecommerce ventures like Shopee last year. After six months of frenetic growth, the Singapore-based company abruptly decided to exit India,

as ET reported first March 28.

Others like US-based social shopping site Poshmark also launched last year, with an eye on the Indian market. The low-end, unbranded and long tail ecommerce market where these companies operate is a hard one to crack in India with measly margins and customers who are not sticky or loyal.