Also in this letter:

■ RBI tells fintech companies to stay in their lane

■ Byju’s allegedly owes BCCI Rs 86.21 crore; Paytm wants out

■ Snap’s poor earnings wipe out $80 billion of value from ad giants

Flipkart’s Adarsh Menon to take over Shopsy, Cleartrip and more in rejig

Long-time Flipkart executive Adarsh Menon will soon head the company’s new business verticals such as social commerce venture Shopsy, travel platform Cleartrip, and its recommerce business, according to an internal memo sent by Flipkart Group CEO Kalyan Krishnamurthy and people briefed on the matter.

Changes: The changes in Menon’s role come after Prakash Sikaria finalised his plans to leave the ecommerce group later this year to potentially start his own venture.

Sikaria was also looking at the engagement and loyalty business, and Menon will head these as well.

Sources told us Sikaria is expected to leave Flipkart only after the company’s flagship Big Billion Days sale over Diwali.

HUL batch: Menon is among the senior Flipkart executives who joined the company in 2015 from Hindustan Unilever Ltd. Over the years, he has been involved in various businesses, including private labels for electronics, furniture and others.

Flipkart’s focus: Sikaria’s exit comes at a time when Flipkart is focussing on scaling its new businesses. Krishnamurthy told us on January 4 that Shopsy, and its grocery, travel and healthcare businesses will drive customer growth in the coming year.

Sikaria told us on July 3 that about a quarter of new customers for the entire Flipkart group come from Shopsy. He said that the company aimed to acquire 100 million customers by the end of the year and was on course to achieve that target.

RBI governor tells fintech firms to stay in their lane

Financial technology and digital lending firms must operate under the licences given to them, Reserve Bank of India Governor Shaktikanta Das said on Friday. He said the unlicensed operations of fintechs could lead to a build-up of risk in the economy, which the RBI could not allow.

“Our responsibility is to maintain financial stability,” Das said. “The firms should operate under the licences granted to them. If they are doing anything beyond that then they should seek our permission. Without permission if they are engaging in activities for which they have no licence then it is not acceptable.”

New rules in weeks: Das also said that the much awaited digital lending norms will be out in a few weeks.

“We want to support innovation and at the same time we want the entire ecosystem to grow in an orderly and regulated manner so that there is no compromise on financial stability,” Das said.

Crackdown: Last month, the RBI issued a mandate that barred non-banks from loading credit lines onto e-wallets and other prepaid payment instruments. The move upended India’s nascent fintech sector, causing several fintechs to update their terms and conditions and some, like Slice, to alter their business models.

The central bank has been highlighting the risks posed to the financial system by fintech and big tech firms. In its recently released Financial Stability Report (FSR) the RBI said the financial system needed shielding from the fintech industry’s potential to cause instability.

Byju’s allegedly owes Indian cricket board Rs 86.21 crore; Paytm wants out

Byju’s, the Indian cricket team’s jersey sponsor, allegedly owes Rs 86.21 crore to the Board of Control for Cricket in India (BCCI), while title sponsor Paytm has asked the board to transfer its rights to a third party, according to a PTI report.

As recently as April, Byju’s and the BCCI had agreed to extend their partnership until the end of the 2023 ODI World Cup in India at a 10% increment.

Driving the news: BCCI Apex Council discussed the issue on Thursday, PTI reported. “As of today, Byju’s owes dues of Rs 86.21 crore to the Board,” a BCCI source told the news agency after the meeting.

Denial: A Byju’s spokesperson said, “We have extended the contract with the BCCI but it is not yet signed. After the contract signing is done, the payments will happen as per the contractual payment terms. So there are no dues pending from our side.”

Byju’s first came on board back in 2019 when mobile manufacturer Oppo transferred the BCCI sponsorship rights to the online tutorial firm.

Paytm: Meanwhile, fintech company Paytm has asked the BCCI to assign its India Home Cricket title rights to Mastercard. The current agreement between Paytm and the BCCI runs from September 2019 to March 31, 2023.

In August 2019, Paytm had extended its association as the title sponsor for international and domestic cricket matches in India by four years with a winning bid of Rs 3.80 crore per match.

Snap’s poor earnings wipe out $80 billion of value from ad giants

Social media giant Snap’s poor Q2 results, which saw it post a net loss of $422 million, led to the erosion of a combined $80 billion in the market cap of ad-selling behemoths Google, Meta, Pinterest and others.

Deets: While shares of Meta dropped 5%, Google and Pinterest declined 3% and 7%, respectively. Snap shares tanked 26% after the results, wiping out $7 billion of its market cap. The company said the poor results were due to a weak economy, rising competition from rival TikTok, and iPhone’s recent privacy changes.

Cautious advertisers: Owing to surging inflation, supply-chain issues and labour shortages, advertisers have been reducing their spending on social media ads of late. Snap is also looking to generate alternate sources of revenue and, akin to tech giants like Meta and Google, will slow down its hiring.

Amazon’s $3.9 billion buy: Meanwhile, Amazon made its third-largest acquisition, buying out primary care company One Medical for $3.9 billion, to deepen its presence in health care services. One Medical is a membership-based service that offers virtual care and in-person doctor visits. It also works with more than 8,000 companies to provide health benefits to employees.

Tweet of the day

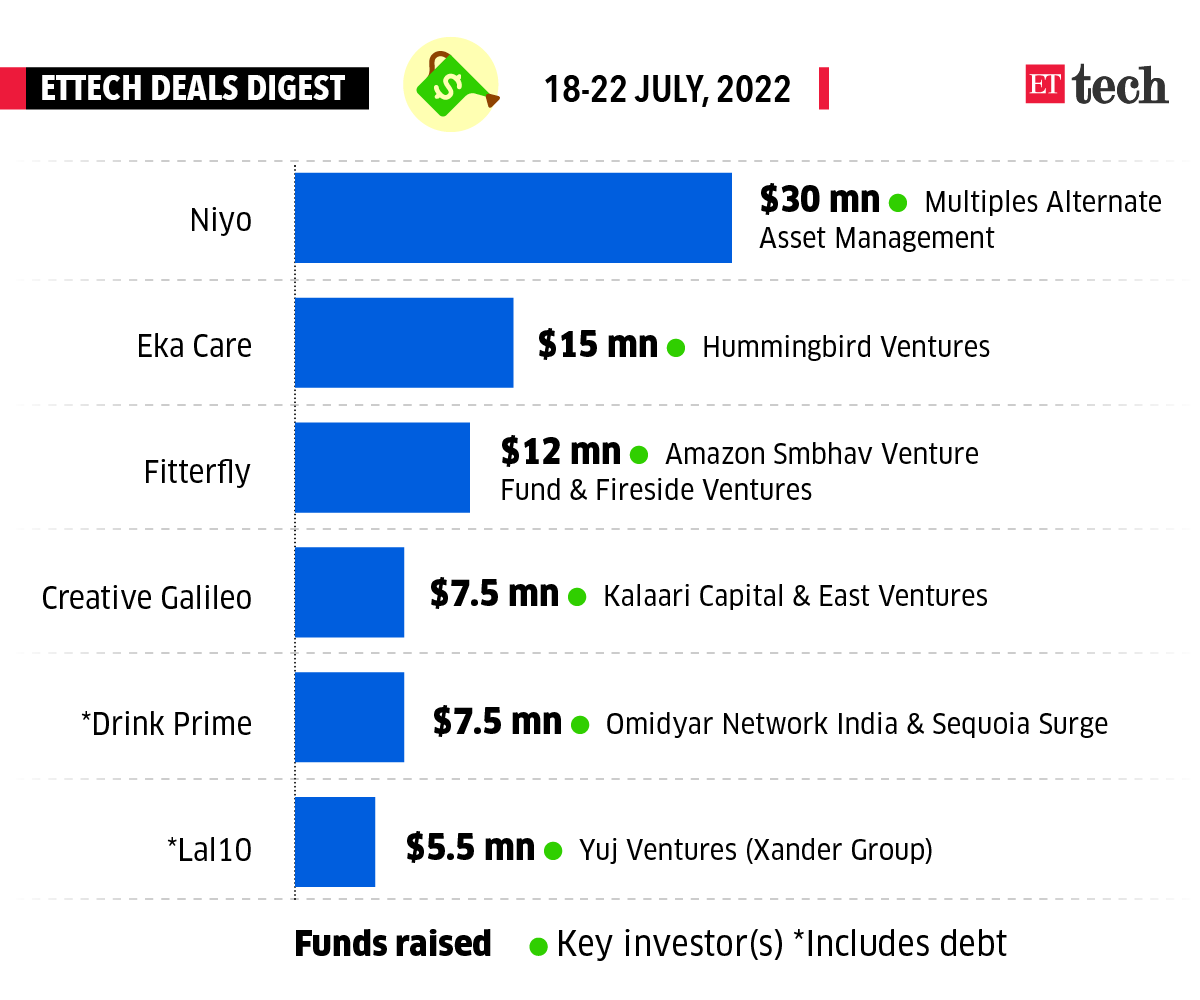

ETtech Deals Digest

Fintech startup Niyo raised the largest amount this week as the funding winter continued to loom over the startup ecosystem. Eka Care and Fitterfly landed the second and third largest amounts, respectively, capping off a quiet week for startups.

Here’s all the startups who raised funds this week

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.