Also in this letter:

■ Flipkart creates Rs 17,000-crore Esop pool

■ Students can register on CoWIN using school ID cards

■ Jupiter snags exclusivity rights from Tiger in new funding

35 non-founders now in Rs 100-crore stock options club

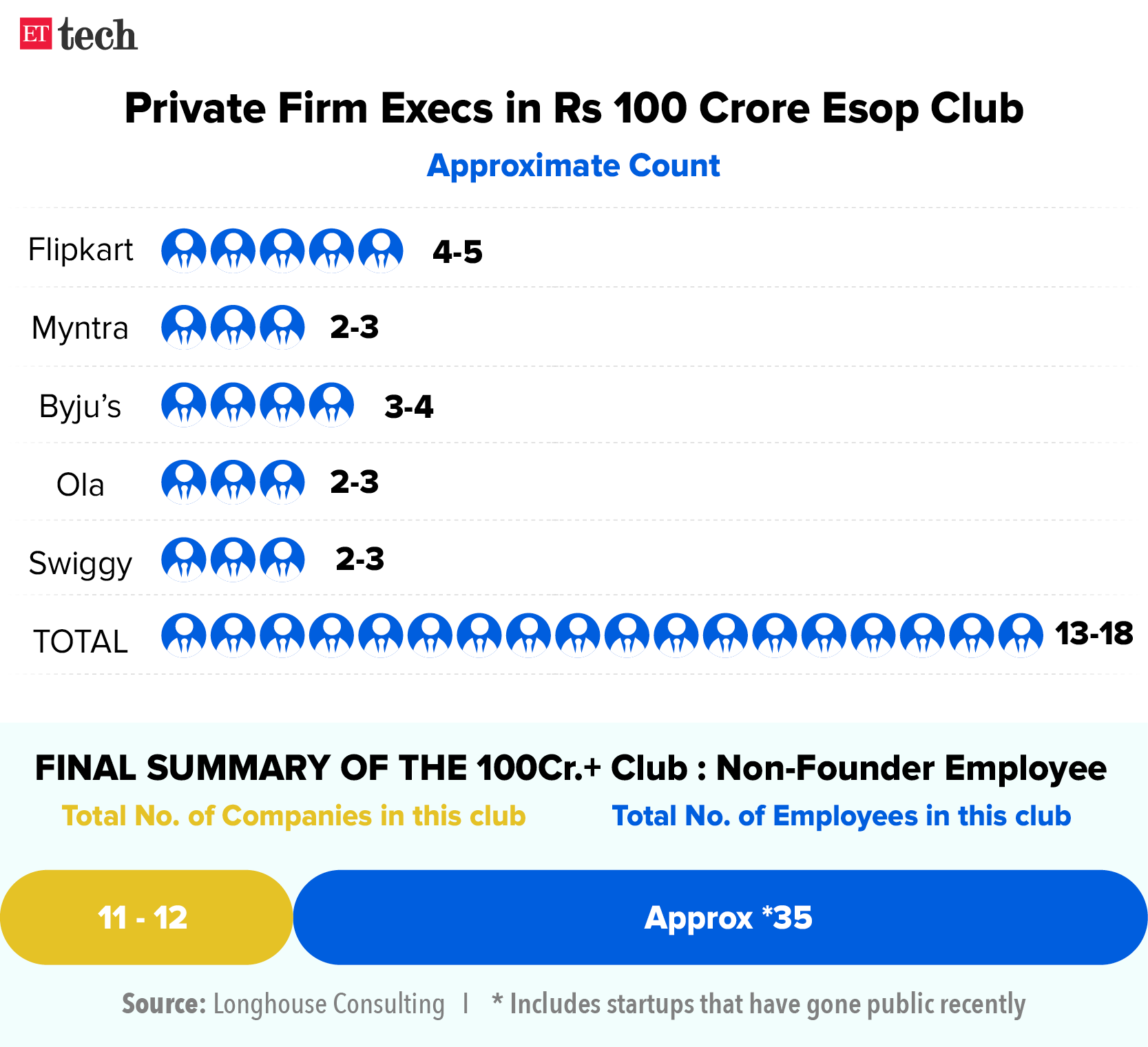

Recently listed startups and privately held tech firms in India have catapulted 35 non-founder executives into the Rs 100 crore club of stock options, creating an elite group in the fast-growing digital economy. That’s according to data from executive search and advisory firm Longhouse Consulting, shared exclusively with ET.

These include public companies such as Nykaa, Zomato, PolicyBazaar and Paytm, and private firms such as Flipkart Group, Byju’s and Ola. By the end of next year, the Rs 100 crore stock options club is expected to have 100 members, according to estimates by Longhouse.

Stock options go mainstream: The growing Rs 100-crore club shows two things – that Esops can lead to actual wealth creation, and that 2021 was the year they went mainstream in India’s startup ecosystem.

Several startups have conducted significant stock option buybacks, especially over the past 12-18 months. We reported last month that close to 40 startups had bought back employee shares worth Rs 3,200 crore, including PhonePe, Razorpay, Udaan, Flipkart, UpGrad, Swiggy and Spinny.

Quote: “With buybacks happening, employees see the opportunity of wealth creation being real,” said Harshil Mathur, cofounder and CEO of Razorpay. “Contrary to the popular misconception that if a company allows Esop buybacks soon, employees will sell and leave, they actually stay longer and do not sell their options in a rush.”

“People have realised that for them to make a significant change in their lifestyle or become financially independent, salary hikes are not enough,” Mathur said, while explaining the significance of Esops. He, however, cautioned that employees should have such commitments formalised in writing along with the conditions under which shares can be sold during buybacks.

Flipkart creates Rs 17,000-crore Esop pool, India’s biggest

Flipkart has created an employee stock ownership plan (Esop) pool worth Rs 17,000 crore, propelling it to the top of the list of Indian tech firms that have given stock options to employees. It is followed by Oyo, Zomato, Paytm and Nykaa, according to data exclusively sourced by ET from executive search firm Longhouse Consulting.

Record year: It’s been a record year for Esops across Indian startups, as more companies conducted buyback programmes, enriching employees.

- Flipkart’s Rs 600-crore buyback was one of the largest this year.

- Zomato and Nykaa meanwhile generated a windfall for investors and employees after they listed on Indian exchanges earlier this year. Zomato’s stock market debut spawned 18 dollar-millionaires, we reported previously.

- Regional language social media platform ShareChat, which entered the unicorn club in April, put together an Esop pool of Rs 462 crore.

Yes, but: Despite the potential for wealth creation, employees still face challenges when it comes to Esops. These include taxation issues when exercising the options, infrequent liquidity programmes, and long-drawn vesting schedules, experts said.

“The biggest issue remains taxation at the time of exercising unless startups are registered under Section 80-IAC and exempted by the Income Tax department under Section 56(2). Less than 300 startups receive the tax exemption, which is not even 0.5% of startups in India,” said Deepak Abbot, a former executive at Paytm and cofounder of gold loan company Indiagold.

Vesting schedules also often do not match the pace of business growth, as startups are becoming unicorns in months, said Pallavi Nautiyal, regional head of Qapita, an equity management platform.

And repeat taxation – in the form of perquisite tax when exercising the options – and capital gains tax during liquidation are other problems employees face, Nautiyal said. “When employees exercise their stocks, they have to pay taxes immediately on the notional gains,” said Abhishek Goyal, cofounder of data platform Tracxn.

Tweet of the day

Students can register on CoWIN using school ID cards from Jan 1

RS Sharma, chief executive of the National Health Authority

Young Indians in the age group of 15-18 years can use photo identity cards issued by their schools to register for vaccination slots on the national vaccine portal CoWIN from January 1, RS Sharma, chief executive of the National Health Authority, told ET, as “many students may not have an Aadhaar card as an identification document”.

India has announced that it will begin vaccinating those aged between 15 and 18 from January 3 and will provide a booster dose to eligible adults from January 10. The CoWIN platform will be upgraded for this.

When will it be available? The health ministry has said that Bharat Biotech’s Covaxin is likely to be made available for young adults from January 3.

Third dose for some: “Those who have got two doses of the vaccines —frontline and health workers as well as people above 60 years with some comorbidities — and have completed nine months from the last dose of the vaccine, will be eligible for the third dose,” according to Sharma, who is also the chairman of the Empowered Group on Vaccine Administration.

Jupiter snags exclusivity rights from Tiger Global in new funding

Jitendra Gupta, founder of Jupiter

Consumer-focused Neobank Jupiter has closed a new funding round co-led by Tiger Global.

Why is it significant? Aggressive investors often bet on many companies in one sector and later double down on the winning horse.

But Tiger Global, in a rare move, has agreed to not invest in any rival consumer-facing neobank in India, sources told us. This is only the second time in India that Tiger Global has agreed to an exclusivity clause like this after a similar move earlier this year when it backed social network platform ShareChat.

Tiger Global, one of the most fervent backers of Indian startups, recently made multiple bets in one sector by backing investment platforms Groww, Upstox and INDMoney.

Quote: “Tiger Global has agreed to the terms of not investing in any direct rival in this space as long as they are invested in Jupiter,” a person aware of the matter said.

Deal details: Regulatory filings sourced from Tofler showed that Jupiter raised close to $86 million in the new funding round. QED Investors, Sequoia Capital India and Tiger Global co-led the round, after which the company’s valuation has more than doubled to $711 million.

Google moves Karnataka High Court against CCI’s probe

Google has filed a writ petition in the Karnataka High Court, seeking more time to respond to Competition Commission of India’s questions on its Play Store rules.

‘No urgency’: The tech giant has argued that since it has voluntarily delayed the implementation of its latest Play Store policy in India until Oct. 31, 2022, there is no “urgency” to the matter. Sources said that the company has also asked for appointment of a judicial member on the panel which is probing the matter and the identity of the complainant to be disclosed in order for the company to respond adequately. The US company has sought eight more weeks to reply.

The anti-trust regulator was pressing Google to respond to its questions by December 31, according to sources. The CCI had earlier sought Google’s response by November 19.

Quote: “We have filed a writ in Karnataka High Court regarding the interim relief application in the Google Play probe by the CCI, seeking to move forward in line with established due process principles. We respect the CCI’s investigative process and will continue to engage cooperatively and constructively in the interest of a fair investigation,” a Google spokesperson told us.

Interestingly, the lawyer representing Google in the Karnataka High Court is Dharmendra Chatur, the same person that Twitter had hired as its compliance officer in June. He had quit the post days after being appointed.

Also Read: Dharmendra Chatur, Twitter’s interim grievance officer for India, quits

Earlier this month, Google said that it was delaying the implementation of its revised Play Store policy by a further six months to October 31, 2022. This followed strident opposition from Indian internet startups, which have termed its payment policies anti-competitive and monopolistic.

India can drive growth in digital, says Dell Technologies

India has the potential to be at the centre of a multi-decade growth opportunity due to the growth in digital and data-led solutions in the country, a top executive of Dell Technologies said.

Quote: The number of unicorns and global companies being built out of India presents a significant opportunity, said Amit Midha, president, Asia Pacific & Japan, Dell Technologies. “That represents a significant multi-decade opportunity ahead in terms of creating economic value, talent growth, employment as well as inclusion.”

Dell’s global revenues were up 20% in the previous quarter at $28 billion, with Asia growing at 50% to $3.2 billion. India is the largest market for Dell in the Asia-Pacific and Japan region.

Other Top Stories By Our Reporters

Bharti-backed OneWeb launches 36 more satellites: OneWeb, a Low Earth Orbit (LEO) satellite communications operator co-owned by the Bharti group and the UK government, launched another batch of 36 satellites by Arianespace from the Baikonur cosmodrome in Kazakhstan.

NPCI says can’t bear USSD mobile banking cost burden: National Payments Corp of India (NPCI), the country’s umbrella organisation for operating retail payments and settlement systems, has urged the telecom regulator not to burden it with the costs of providing unstructured supplementary service data (USSD)-based mobile banking and payment services.

Global Picks We Are Reading