Ecommerce majors Flipkart and Amazon, and new players like Meesho, had an eventful year. Another big development was the launch of the much-hyped Open Network for Digital Commerce (ONDC).

Here’s a look back at the top stories and developments that shaped India’s ecommerce universe in 2022.

Flipkart vs Amazon and others

After a relatively muted start in terms of user consumption in the first half of the year, etailers like Flipkart and Amazon saw an uptick in demand leading up to and during the festive sales.

Flipkart group CEO Kalyan Krishnamurthy told ETtech about it during this interview. In the first week itself demand across segments like electronics, grocery, personal care, health and pharma were 40-60% higher compared to last year.

Discover the stories of your interest

This set the stage for an intense battle among the etailers

and they weren’t disappointed with consumer demand.

ETtech

ETtechWalmart-owned Flipkart largely maintained its lead over Amazon India, according to ETtech’s analysis, based on inputs from industry executives and reports. Meesho also said it had seen its best-ever festive season sale, echoing Amazon India. The Tata Group and Reliance Industries didn’t make a serious dent in market share of the incumbents.

But there was more that happened outside the festive season sales.

Flipkart, after making multiple M&A

investments last year, largely focussed on scaling new business verticals like social commerce (through Shopsy) and travel (through Cleartrip), besides grocery and at-home services. Shopsy is a direct rival of Meesho.

Both Flipkart and Amazon also opened up their

logistics arms, Ekart and

Amazon Transportation Services, respectively, to serve external orders. They also made their most aggressive bets on live commerce yet.

Read more about it here

Countdown begins: Flipkart, Amazon gear up for festive battle.

Amazon India 2022: For Amazon, this was a relatively disruptive year. While it continues to be bullish on India, the US etailer had quite an interesting year.

It finally shut down its major seller Cloudtail after years of regulatory pressure and said it would do the same for another large

seller firm, Appario Retail, in the next year.

ETtech

ETtechAmazon had stakes in both seller firms. This meant Amazon had to make several changes to ensure its ecommerce operations ran as smooth as possible.

Read ETtech’s analysis here on

how mini Cloudtails have surfaced on Amazon India.

Amazon’s progress in 2022 was flagged as unimpressive by Bernstein,

which said it continued to face regulatory hurdles in India. The etailer has now spent nine years here. It decided to shut multiple smaller businesses here like food, edtech and others.

But its country manager Manish Tiwary told us it was only shutting experiments that didn’t work and that the Seattle-based firm remained committed to one of is biggest markets outside the US.

Read out interview with Tiwary here:

Amazon relooking experiments, not shutting businesses

Amazon also acquired social commerce firm Glowroad while its India head

Amit Agarwal was given additional responsibility of the APAC market as well.

Meesho, FirstCry, Tata Neu others: SoftBank-backed challenger ecommerce firm Meesho was aggressively taking on bigger rivals like Flipkart and Amazon but

had to make necessary changes in its spends as the funding winter took hold.

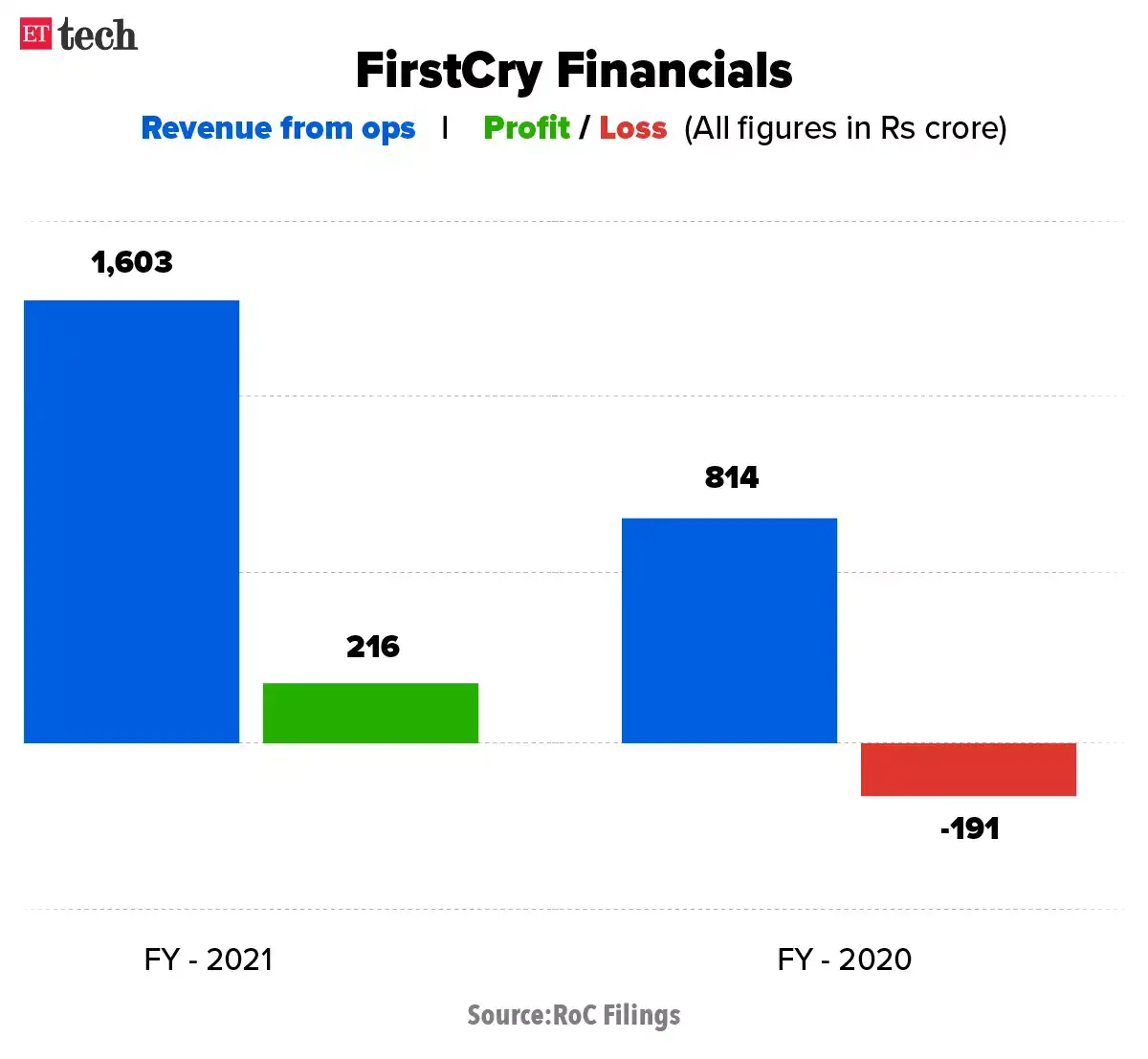

Vertical etailer

FirstCry almost finalised a $1 billion IPO plan but

had to postpone it, citing market conditions. We reported how it is

working on a secondary share sale to bring SoftBank’s shareholding to below 25% so it can revive its IPO plans in the new year.

ETtech

ETtechTata Digital finally launched its ‘super app’ Neu but it’s been a bumpy ride for the Mumbai-based conglomerate in ecommerce – from

slow sales to constant changes in its top-ranks. Egrocer BigBasket and epharmacy 1mg remain its key growth drivers.

Delhivery IPO, logistics shake up: If the subject is ecommerce, logistics can’t be far behind. Delhivery, despite the volatile market conditions,

went ahead with its IPO and had a successful run on the bourses till a few months ago when a guidance on shipments volumes in the coming months led to a massive drop in its share price.

Logistics vs aggregators, consolidation:

ETtech broke a series of stories on how top three third-party logistics players Delhivery, Ecom Express and Xpresbees simultaneously increased fees for orders coming from aggregators like Shiprocket and others.

As a result, consolidation was soon underway. Shiprocket acquired smaller rival

Pickrr in a $200 million deal. The dust here hasn’t fully settled and there might be more such action in 2023.

ETtech

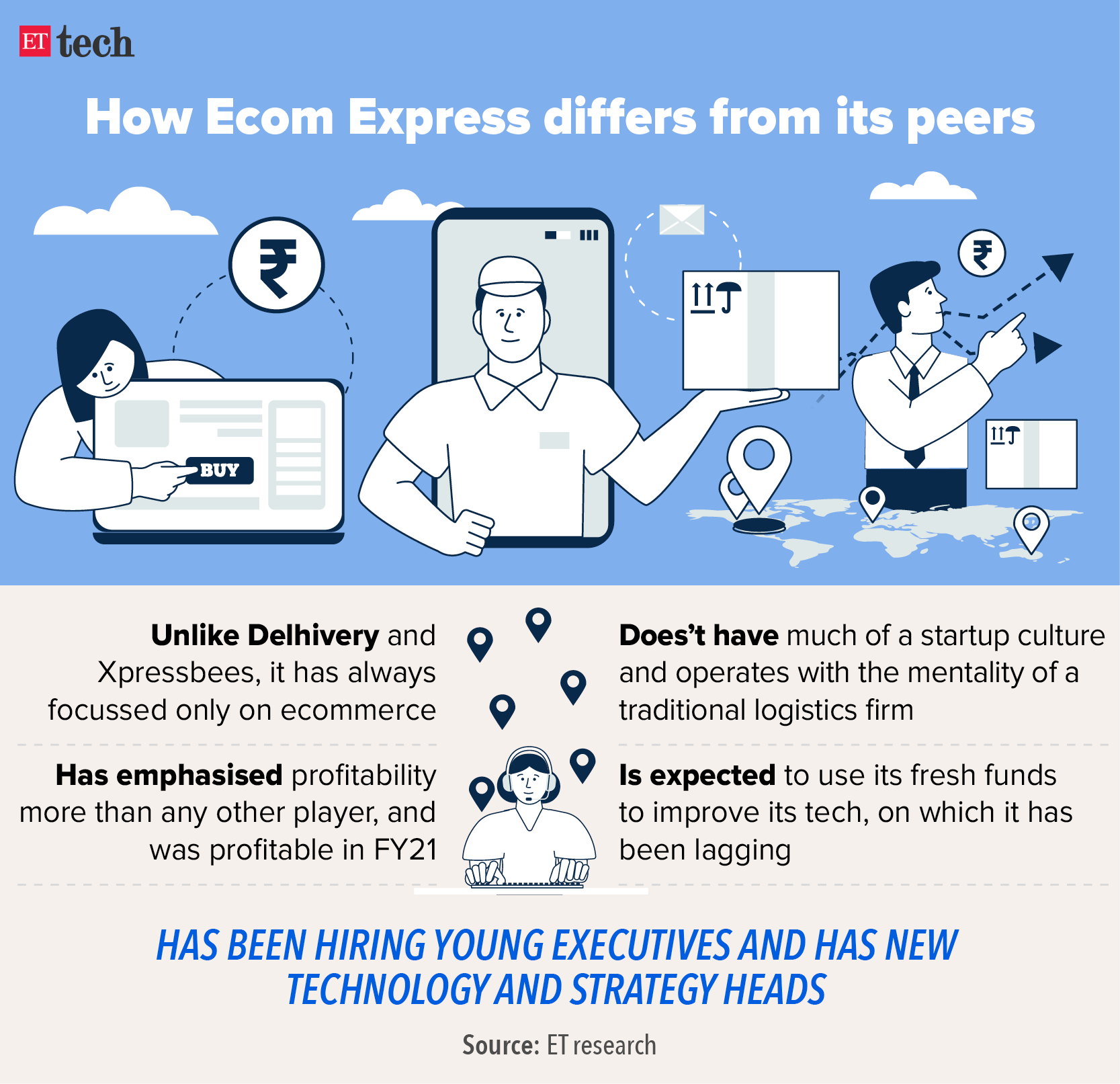

ETtechEcom Express, Rivigo fire sale and Shopee exit: Ecom Express, a rival to Delhivery and Xpressbees, had a tough year and lost its number-two position in the ecommerce logistics space after a long time.

ETtech Long Read:

Why Ecom Express is trailing its rivals in the logistics industry’s game of thrones.

2022 also marked one of the biggest firesales – that of logistics unicorn Rivigo.

It was in talks with multiple players including Flipkart and Xpressbees for a sale but

Mahindra group finally bought its B2B express biz for a mere Rs 225 crore.

Last but not least,

Singapore-based Shopee’s abrupt exit from India was a surprise to many. That also added to Ecom Express’s worries as it was servicing a large number of deliveries for the firm.

Roll-up ecommerce: After back to back funding rounds in Thrasio clones like Mensa Brands and Globalbees last year, the hype around this business model seems to have settled during 2022.

ETtech

ETtechNext year may be make-or-break for many of the operators in the space.

We reported how Thrasio was changing its plans for India thanks to turbulence in its home market,

while a shakeup is imminent across the wider industry.

That’s all from us for now, but we have more in store for you in 2023.

(Graphics & illustrations by Rahul Awasthi)