Also in this letter:

■ Narayana Murthy on capital for startups

■ Gamers bypass rules to play real-money games

■ IT worker body files complaint against TCS over transfers

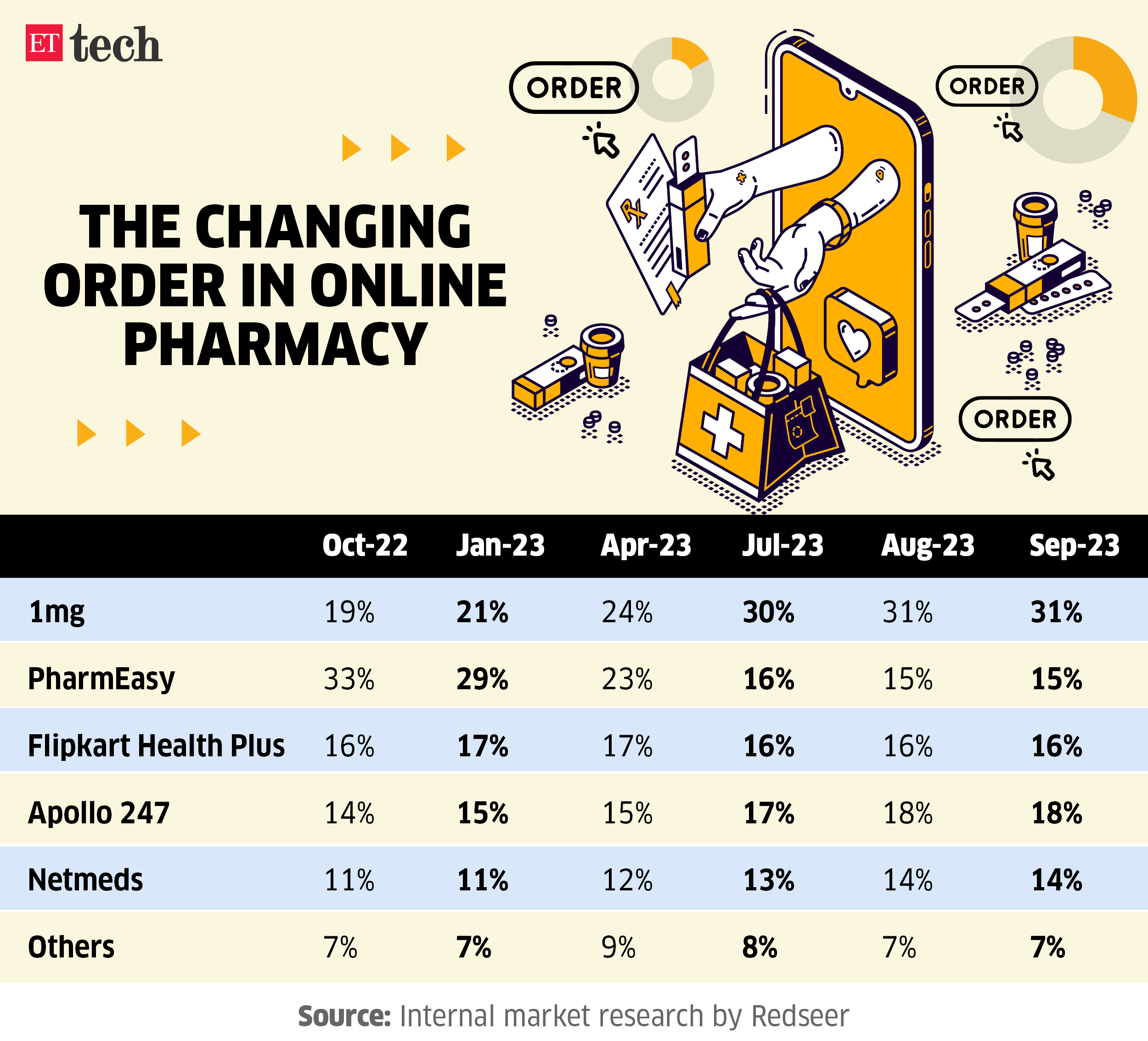

1mg overtakes PharmEasy in market share in top order change

A change in the top order of the epharmacy sector has been underway for some time now. We have the data. So, let’s dive in:

Top-order changes: Tata Digital-owned 1mg has pipped PharmEasy to the top of the country’s e-pharmacy market in terms of gross merchandise value (GMV) after a year of consolidation and tighter cost controls at top firms in the sector.

Number game: Tata 1mg had a 31% market share in September 2023 against 19% in October 2022 while PharmEasy slipped to 15% from about 33% during the same period, according to a data analysis by third-party internet market research firm Redseer, which ET has seen.

In the making: At least three senior industry executives confirmed a directional shift in market share dynamics this year, and that it has been underway since early 2023, at least. For example, PharmEasy had about 29% share in January which slipped to 20% in May. During the same period, 1mg’s market share improved from around 21% to 27%, they said.

Reasons behind numbers: This has happened as PharmEasy has been cutting its marketing spends continuously to prioritise profitability plans as part of a restructuring exercise over the past year. Also, it had a mounting debt to clear from Goldman Sachs and finally closed a Rs 3,500 crore rights issue.

What about others? Major platforms such as Flipkart Health Plus, Reliance-Netmeds, and Apollo have largely maintained their GMV market share at 15-18% during the same period, as per Redseer data, which is not public and has been circulated among industry executives.

Also read | Tata 1mg will be profitable in a few quarters, says founder Prashant Tandon

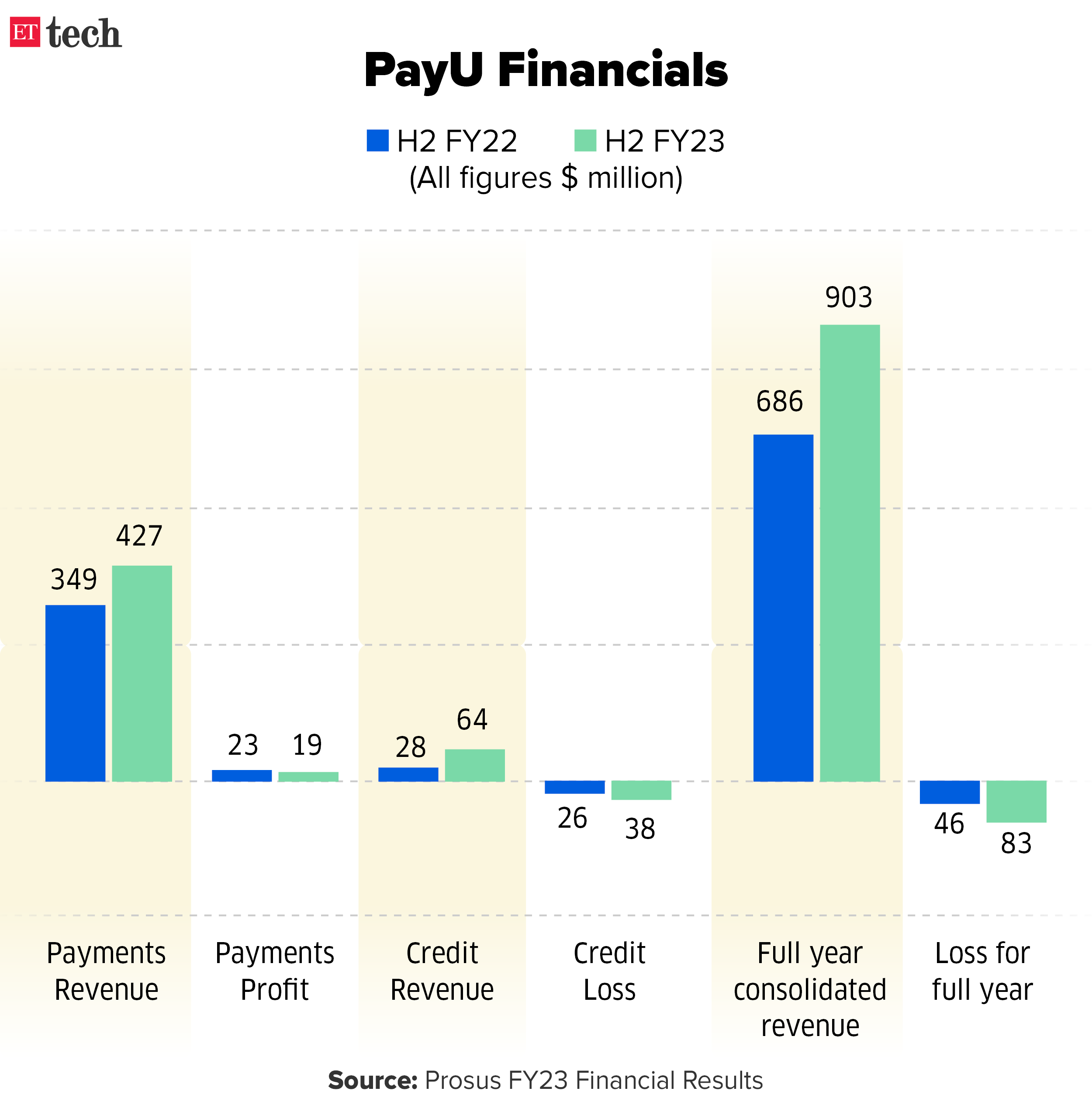

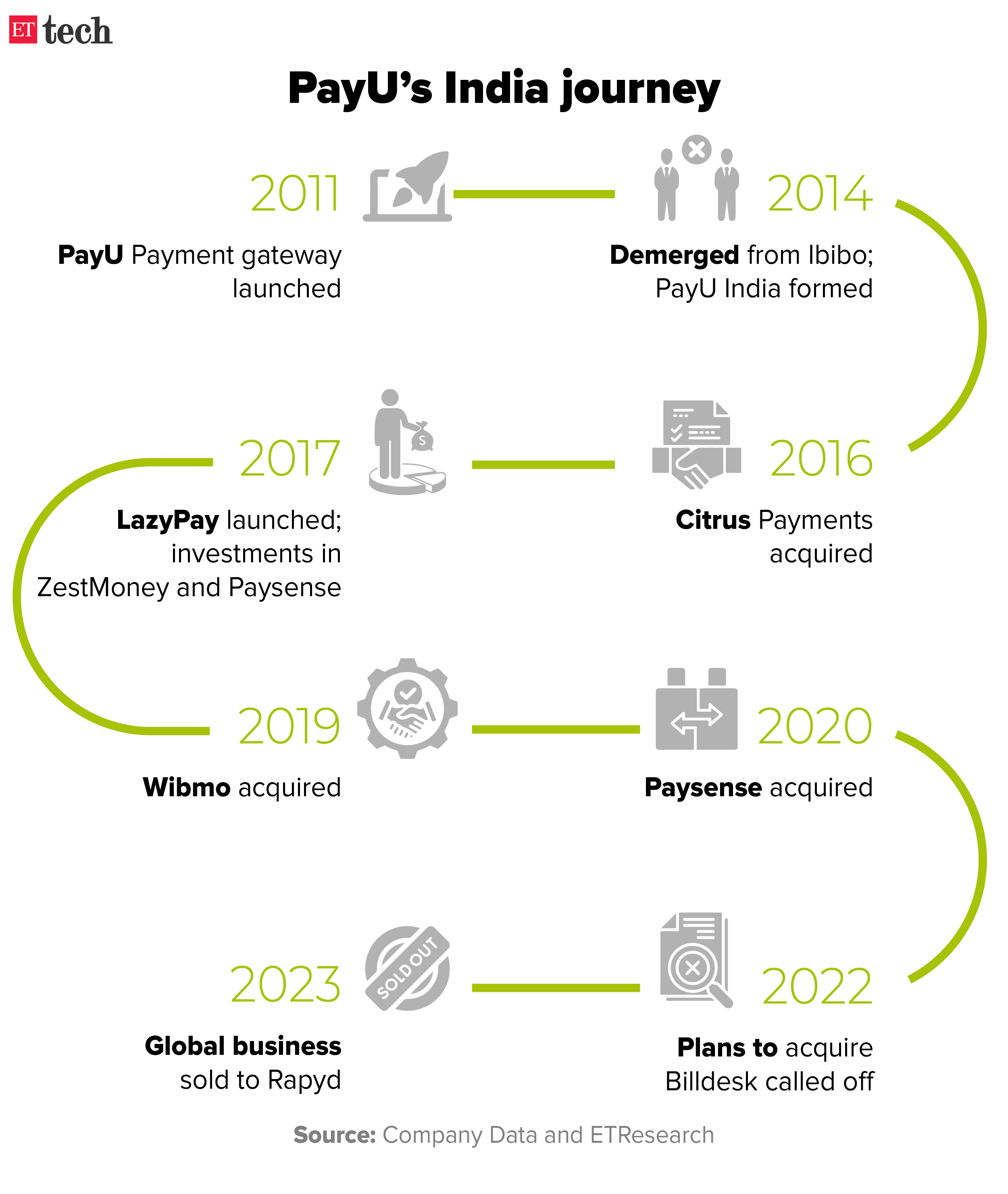

PayU eyes B2B pay, credit play under new top brass

Vijay Agicha, PayU’s global head of strategy, M&A, and investment

PayU is getting into new business areas, exploring options around business-to-business payments and supply chain financing. The ecommerce payments major wants to focus on QR codes for offline merchant payments, staying away from the expensive point-of-sales terminal business.

Creating a full stack: After focusing on merchant payments and consumer credit, PayU is trying to create an entire payments ecosystem around merchants. It uses its payment gateway business to acquire merchants and offer its consumers checkout credit and personal loans. Through Wibmo, PayU offers fraud detection services to banks and now with B2B payments it can help merchants with their vendor payments too.

Starting afresh: PayU went through a major reshuffle exercise recently. Its entire top deck, including the Prosus CEO Bob van Dijk and PayU Global CEO, quit. Its CFO and the top boss at PayU Finance moved out too. Currently, Anirban Mukherjee, the head of its India business, has been elevated to the position of CEO of PayU. And its global payments business has been sold off to Rapyd. PayU is looking for a public listing in India soon, sources told ET.

Regulatory clearance: The Prosus-owned company has applied for its payment aggregator licence afresh. The Reserve Bank of India had rejected its previous application earlier this year. PayU told ET that they have incorporated the changes as suggested by the RBI and are hopeful about getting the in-principle approval soon.

RBI returns Instamojo’s PA application; firm intends to reapply

Sampad Swain, cofounder, Instamojo

With the Reserve Bank of India (RBI) returning Instamojo’s application for a payment aggregator (PA) licence, the fintech company now plans to resubmit its application after a year, cofounder and chief operating officer Akash Gehani told ET.

The reason: The RBI’s decision to not grant Instamojo the licence is linked to the company not meeting its net worth criteria. Gehani said there was a difference in the way the RBI and the company calculated the net worth of the payment gateway business.

The impact: The move has come as a big blow for the Bengaluru-based firm which derives almost three-fourths of its revenues from providing payments to merchants. It is also expected to impact revenue margins and topline for the 11-year entity. The platform has seen some merchants log out, with monthly total payment volume down 30%, as an immediate effect, Gehani added.

Also read | RBI lens on payment firms seeking aggregator tag

Narayana Murthy moots sops to fuel flow of domestic capital to startups

Infosys cofounder NR Narayana Murthy suggested incentives for private and public funds to set aside a portion of their capital for boosting domestic investment in Indian startups in an interview with ET. Murthy also hailed the Narendra Modi government for drafting the National Education Policy.

Some key takeaways:

On tech downturn: I am not that much deterred by slowness. Every business has ups and downs. Every industry or nation has business cycles. But when we are in the trough part, the market is limited, growth is limited, and there is tremendous competition.

On startup funding: Most of the capital that goes into ventures today in India comes from outside. The need of the country is for more domestic capital to go into startups. And for that to happen, we must work with the government to ensure that the pension funds, LIC, the GICs, other government institutions, private institutions, and HNIs, reserve a percentage of the money for startups.

Real money egaming banned? Players now game the system

Gaming enthusiasts are devising innovative ways such as making groups on WhatsApp or Telegram, or using Virtual Private Networks to continue playing on real money gaming apps banned across states like Telangana, Odisha, Arunachal Pradesh, and Sikkim.

Easy hack: Lawyers and industry experts told ET that such instances are growing more organised by the day and are almost impossible for the authorities to catch. “Playing with friends on non-real money poker apps and setting the stakes on messaging apps is one of the most common ways that people manage to play banned games in regions where it is restricted or banned,” said one lawyer who specialises in gaming and tech policy.

Tell me more: People are not just betting on poker and rummy, but on casual games like Ludo as well. Players can join groups on Telegram and play with strangers. One such group – titled Ludo King Betting Group India – has 16,121 members. Upon joining, a player is asked by the admin to pay the desired amount for betting via UPI.

Modus operandi: People use apps like JJPoker where a user can set their private table for which a unique code is created. People can join by simply logging in from their devices after keying in the code. Another app, PPPoker, follows a similar model. Here, one user takes on the role of an “agent” and purchases chips by paying in diamonds.

Also read | Indian game streaming companies eyeing a bigger play abroad

NITES alleges forced employee transfers at TCS, files complaint

The Nascent Information Technology Employees Senate (NITES), an IT sector employee rights organisation, has filed a complaint with the labour ministry against Tata Consultancy Services (TCS) alleging that the IT major is forcefully transferring over 2,000 employees.

No consultation: NITES alleged that TCS has initiated transfers of employees to different base locations without consulting them. The affected employees are required to relocate to the new location within 14 days or stand to have their salaries deducted. ET has reviewed a copy of the letter.

Catch-up quick: This comes at a time when the IT services sector, led by TCS, is urging employees to return to offices on all days of the week. ET has reported earlier that after TCS, other large firms including Infosys and Wipro have also mandated work from office for their employees, a few days a week.

Other Top Stories By Our Reporters

All you need to know about YouTube’s approach to responsible AI: YouTube on Tuesday said it was putting in place a slew of updates to further its approach to responsible AI innovation. India is YouTube’s largest market where the Google-owned video streaming platform has about 462 million users as of October.

Keychain raises $18 million in seed funding round led by Lightspeed: Keychain, a manufacturing platform for the packaged goods industry, on Tuesday said it has raised $18 million in a seed funding round led by Lightspeed Venture Partners.

Global Picks We Are Reading

■ Underage Workers Are Training AI (Wired)

■ Uber failed to help cities go green — will robotaxis, too? (The Verge)

■ How China took over the world’s online shopping carts (Rest of world)