Your credit score, which is three digits and measures your creditworthiness, is very important for deciding how much money you will have in the future. Lenders, landlords, and insurance companies use your credit score to evaluate your capacity to pay back debt and manage your finances.

As a result, understanding your credit score and how to raise it is essential to effective credit management.

Getting a handle on your credit score:

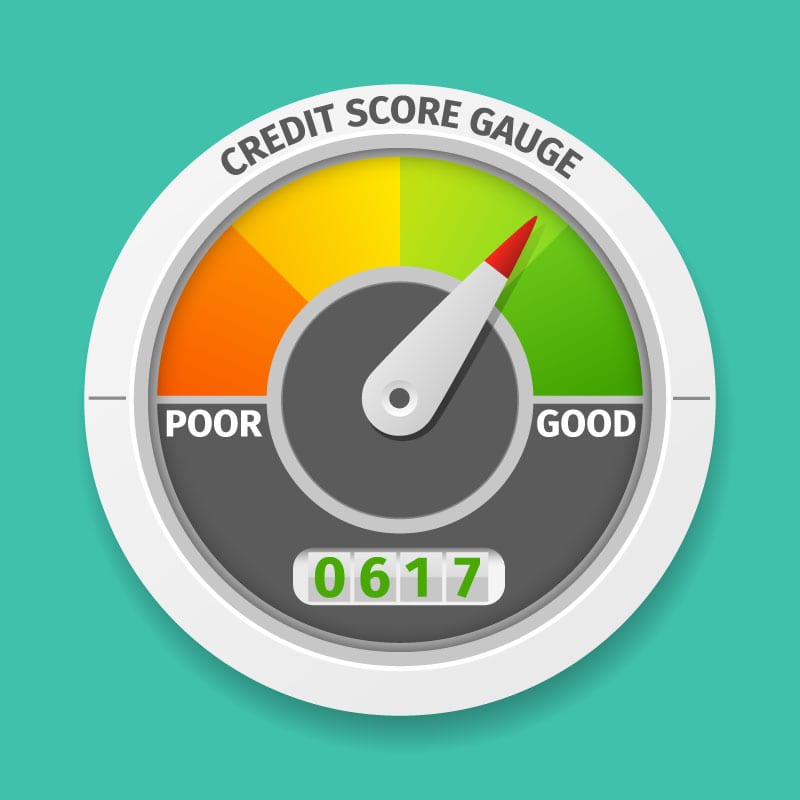

Your credit report’s details determine your credit score, which ranges from 300 to 850. Data on your credit history, including your credit accounts, payment history, and any pending debts, is gathered and maintained by Equifax, Experian, and TransUnion.

The most widely used credit score model is the FICO score, which is used by 90% of reputable lenders. The FICO score is affected by five factors: credit utilization, payment history, the length of credit history, the credit mix, and new credit. Payment history accounts for 35% of your credit score, along with credit mix (10%), credit utilization (30%), length of credit history (15%), and new credit (10%).

Getting a Credit Score Check:

To ensure that the information on your credit report is accurate and up-to-date, it is essential to check your credit score on a regular basis. You are entitled to a free credit report once a year from each of the three major credit bureaus. You can also check your credit score for free on some websites and apps; others may charge you.

Getting a better credit score:

If your credit score isn’t where you want it to be, there are a few things you can do to raise it:

Your credit score could be seriously harmed if you don’t pay your bills on time. Make sure you pay all of your bills on time, including your loan repayments, credit card bills, and utility bills.

Reduce your debt from credit cards; A high credit card balance can hurt your credit score. While working as hard as you can to reduce your credit card debt, keep your credit usage ratio below 30%.

Reduce the number of new credit applications you submit because each one triggers a thorough inquiry that has the potential to lower your credit score. Keep your credit application volume under control and only apply for credit when you absolutely need it.