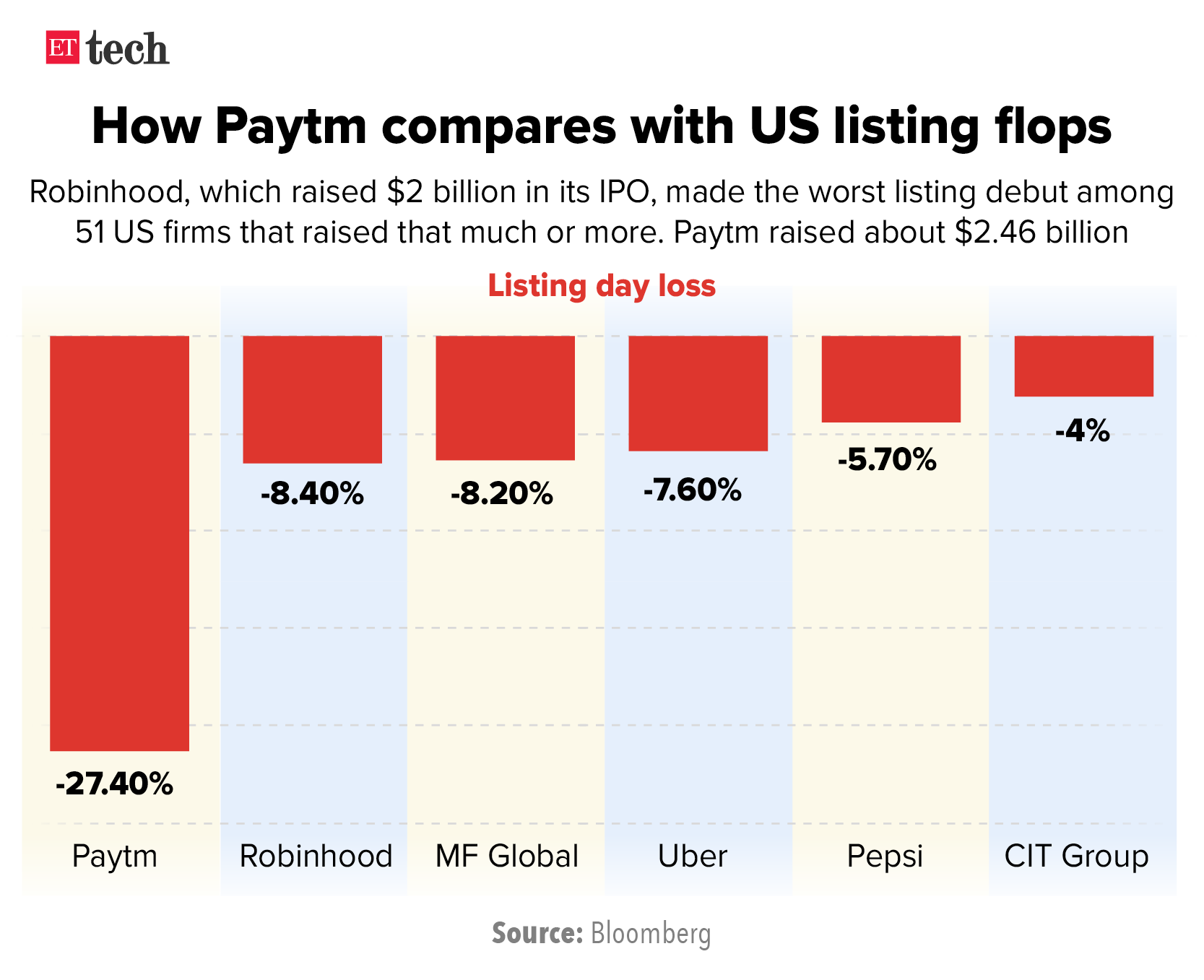

What actually happened on listing day shocked everyone. In the end Paytm’s shares were down more than 27%. Its nightmare debut eclipsed—by some margin—the worst US listing flops by companies that raised a similar amount in their IPOs.

Also in this letter:

- Google prepared for more scrutiny in India: country head

- Tech-savvy teachers pick edtech startups over return to school

- Alibaba warns of slowest revenue growth since 2014 debut

After India’s biggest IPO, Paytm shares plunge 27.4% on debut

Paytm founder Vijay Shekhar Sharma

Shares of Paytm’s parent firm One97 Communications tumbled more than 25% on its first day of trading today, as investors questioned its lack of profits and lofty valuations in the country’s largest IPO ever.

Flop show: We reported Paytm’s stock was trading on the grey market at a premium of just Rs 20-25 on Wednesday, which indicated that its listing would be less than stellar. But a 27.4% fall in the share price at the end of the first trading day surprised even the company’s biggest critics.

- Shares changed hands at Rs 1,614 in the afternoon trade, down from the offer price of Rs 2,150, valuing the firm at about $14.2 billion. That’s less than the $16 billion Paytm was valued at two years ago, in November 2019, when it raised $1 billion from T Rowe Price, Ant Financial, SoftBank Vision Fund and Discovery Capital.

Things got worse from there, and Paytm’s shares eventually hit the lower circuit limit of Rs 1,564 on the BSE. This meant Paytm’s stock could only be bought at that price or higher.

Founder’s response: Paytm founder and CEO Vijay Shekhar Sharma, who was visibly crying with joy at the opening ceremony, later told us that this should be only seen as its “first day” on the markets and not be taken as the company’s long-term performance.

“What today proves is that young, fledgling technology companies which do not have the pedigree of big (family) names can still build incredibly large companies.”

Some saw it coming: Before the listing, Macquarie Capital Securities initiated coverage on the company with an “underperform” rating and a price target of Rs 1,200, 40% lower than the Rs 2,150 IPO price.

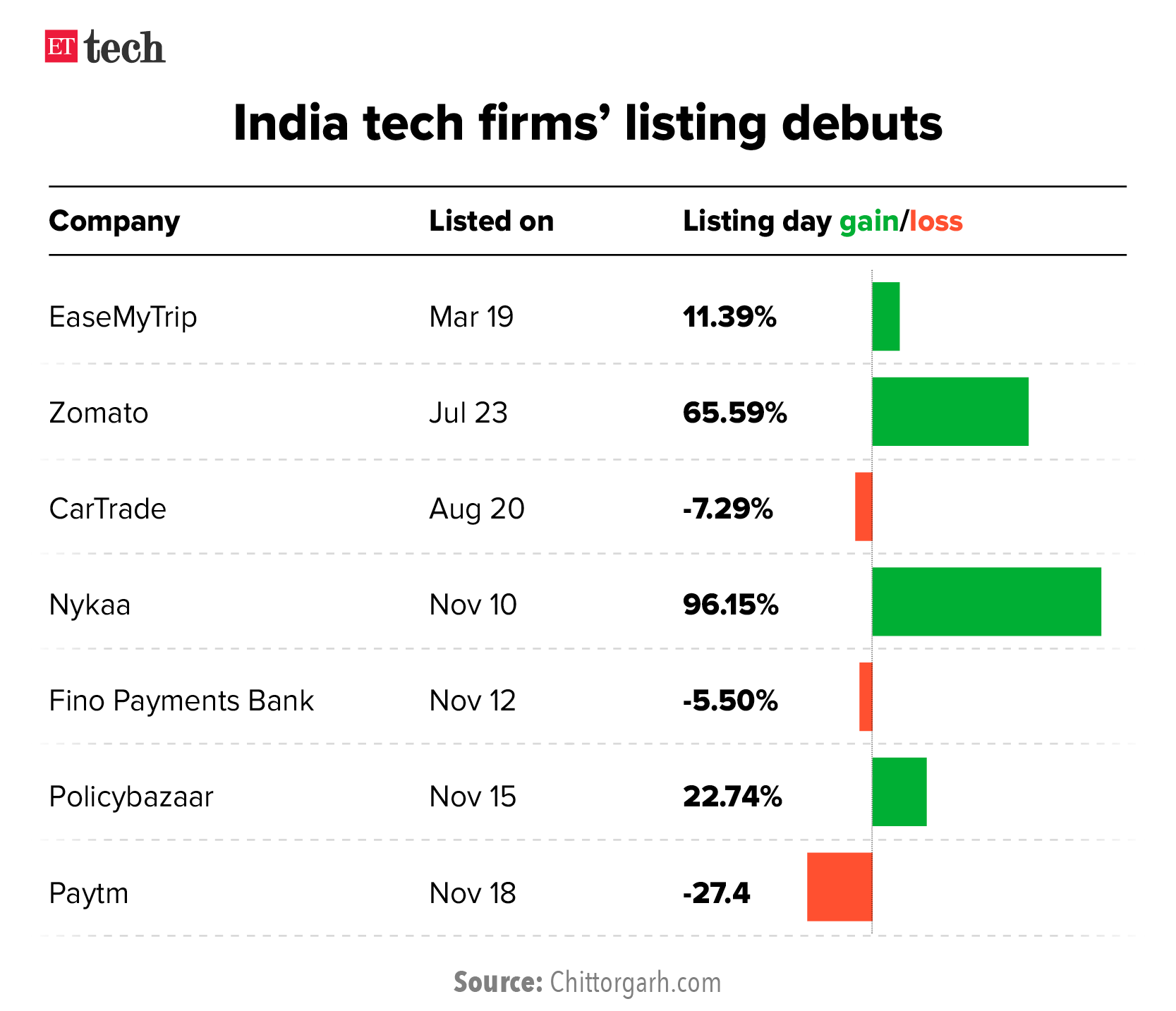

Paytm’s flop debut comes after a string of successful listings by Indian tech startups. Shares of Zomato had hit the upper circuit on its listing day before ending the trading session 66% higher, while Nykaa’s stock nearly doubled from its issue price on its market debut.

Paytm’s nightmare listing eclipses worst US flop debuts of similar size

Paytm’s nightmare listing debut was easily the worst of the seven Indian tech startups that have gone public this year. It even eclipsed the worst trading debuts ever by US firms that raised at least $2 billion in their IPOs. Paytm had raised about $2.42 billion.

Three of the seven Indian tech startups that have gone public so far this year—CarTrade, Fino Payments Bank and now Paytm—ended their first sessions down from the listing price. While CarTrade’s stock plunged 7.29% on the first day, Fino’s fell 5.5%.

At the other end of the scale, Nykaa ended its first day with its stock up an astonishing 96.15%, while Zomato’s stock was up more than 65% after its listing debut.

Biggest US flops: Paytm’s 27.4% fall on day one also eclipsed the worst trading debuts by US firms that raised $2 billion or more in their IPOs, according to data from Bloomberg.

The worst of these was the debut of trading app Robinhood in July. The company raised $2 billion in its IPO but its shares fell 8.4% from the opening $38 to just above $34 at the end of the first day, giving it a market capitalisation of around $29 billion, short of the anticipated $35 billion. This meant Robinhood’s listing debut was the worst among 51 US firms that raised a similar amount or more in their IPOs, according to Bloomberg data.

Before RobinHood, the worst trading debut by a US company was that of another brokerage, MF Global Holdings Ltd, which went public in 2007. It ended its first day down 8.2%.

Tweet of the day

Google prepared for more regulatory scrutiny in India, says country head

Google India head Sanjay Gupta

Google is prepared for more scrutiny from regulators as the Internet becomes deeper in India and around the world, its country head Sanjay Gupta told us in an exclusive interview.

At its flagship Google for India event on Thursday, the company announced a slew of new initiatives and product changes, including local language and voice support in search, digital payments and vaccine slot booking, and Rs 110 crore in financing for micro-enterprises.

Edited excerpts from the interview:

Even though India is the largest market for Google in terms of users, revenue is still low. What will be the main drivers of revenue going forward for Google?

Over the next five years, advertising revenues will start growing more significantly, especially led by digital and tech and startups, because they would like to build new brands and new businesses. They would like to be very targeted. I see a growth of advertising revenues on digital in the future.

Our business model has been largely led by advertising. The one big paradigm shift that we see is our cloud services, because that’s a B2B business, and we start earning revenues as people start embracing technology with us. The cloud business is really opening up the next set of opportunities.

What is your view of the Indian startups space and what is happening right now with IPOs and unicorns and money coming in?

The reality is that we (India) are likely to become a $4 trillion economy. A trillion dollars will be digital. I’m sure 50% of that will come from startups. Fundamentally, the growth of the Indian economy will be driven deeply by startups in a very significant way. So our commitment to startups is very, very high. With the Google for startups accelerator that is in the sixth year, we have touched more than 80 companies in India. Those companies have been able to get close to $2 billion investments.

To read the full interview, click here.

Also Read: Google announces new India-specific product features

Tech-savvy teachers pick edtech startups over return to school

Students may be heading back to school for in-person classes but at least some of their teachers are choosing to continue with virtual classes, ditching the chalk and blackboard for edtech startups.

Why? A combination of the desire to continue working remotely, the digital skills they picked up while conducting classes virtually, and the prospect of higher pay that well-funded startups are able to offer is driving this trend, industry stakeholders told us.

Small numbers, big problem: While the number of such teachers is still tiny, the growing trend nonetheless poses a challenge for private schools.

Exact data is hard to come by but this is a growing concern for private schools, especially those that have invested in training teachers to use technology during the pandemic, said Maya Menon, founder-director with Bengaluru-based The Teacher Foundation, which works with schools across the country. “Teachers have even revealed that they can get hired by edtech companies since they’ve honed these skills in the last year-and-a-half.”

Edtech startup Vedantu, recently valued at more than $1 billion, said it has seen a definite spike in applications from those with a traditional teaching background during the pandemic.

“What we’ve also noticed in our hiring and onboarding of late is that they (teachers) have become a lot more comfortable with online tools. Earlier, we would have to put in a lot more effort in training because they were used to the offline world,” says Nikhil Pawar, head of curriculum, early learning, at Vedantu. The number of teacher’s on its platform has tripled to more than 2,500 since the pandemic began.

Alibaba warns of slowest revenue growth since 2014 debut

On the day that Paytm parent firm One97 Communications made one of the worst market debuts by a company of its size, its Chinese counterpart Alibaba Group forecast annual revenue to grow at its slowest pace since its 2014 debut, and its second-quarter results missed expectations amid slowing consumption and tighter regulatory scrutiny in the country.

Details: For the reported quarter, the e-commerce juggernaut’s revenue growth rose 29% to 200.69 billion yuan ($31.44 billion), its slowest growth rate in six quarters. Analysts on an average had expected revenue of 204.93 billion yuan, according to Refinitiv data.

Stock falls: US-listed shares of Alibaba, which expects its fiscal year 2022 revenue to grow by 20- 23%, were down 3% before the opening bell today. The company last week recorded its slowest sales growth during its annual Singles’ Day, the world’s biggest online shopping fest.

China’s big tech companies have also been under pressure as the country’s regulators clamped down on powerful players from Alibaba to ride-hailing giant Didi Global Inc, citing anti-monopoly and security reasons.

The regulatory crackdown had also hurt Chinese gaming and social media giant Tencent Holdings, which posted its slowest quarterly revenue growth since it went public in 2004.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.