[ad_1]

Last Updated:

After sensitive details from Saif Ali Khan’s health insurance claim were leaked on social media, a doctor claimed that such an amount would never be sanctioned for a common man by any health insurer

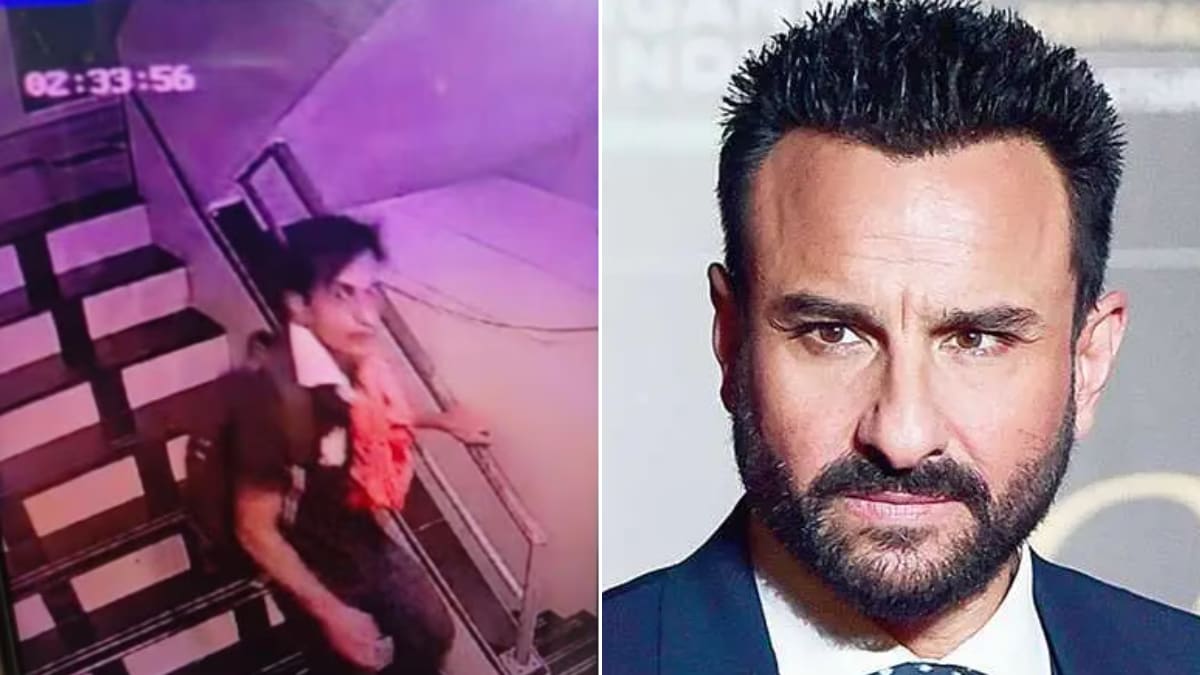

An intruder stabbed Saif Ali Khan several times at his Mumbai residence on Thursday | Image/File

After sensitive details from Saif Ali Khan’s health insurance claim were leaked on social media, showing that the Bollywood actor applied for a claim of Rs 35.95 lakh, a doctor disclosed that such a substantial amount would never be sanctioned for a common man by any health insurer.

Saif Ali Khan fell victim to a violent incident when an intruder broke into his residence in Mumbai’s Bandra West and stabbed him multiple times. He was rushed to Lilavati Hospital for treatment by his seven-year-old son, Taimur.

A cardiac surgeon from Mumbai, Dr Prashant Mishra, highlighted the struggles of middle-class policy holders and said that Niva Bhupa, a health insurer, would never sanction more than Rs 5 lakh to the common man for such treatments.

In a post on X (formally Twitter), he wrote: “For small hospitals and common man, Niva Bupa will not sanction more than Rs 5 lakh for such treatment. All 5-star hospitals are charging exorbitant fees and mediclaim companies are paying also. result – premiums are rising and the middle class is suffering.”

For small hospitals and common man, Niva Bupa will not sanction more than Rs 5 lakh for such treatment. All 5 star hospitals are charging exorbitant fees and mediclaim companies are paying also .result – premiums are rising and middle class is suffering. https://t.co/jKK1RDKNBc— Dr Prashant Mishra (@drprashantmish6) January 18, 2025

The mediclaim document submitted for the treatment of the Bollywood actor shows a claim of Rs 35.95 lakh for his medical treatment, of which Rs 25 lakh has already been sanctioned by the insurance provider.

CNN- was not able to independently verify the authenticity of the mediclaim being circulated on social media.

However, Niva Bupa Health Insurance company confirmed the claims and said: “A cashless pre-authorisation request was sent to us upon his hospitalization and we have given approval of an initial amount to start the treatment.”

In December 2024, the 55th GST Council meeting postponed its decision on reducing premiums for health and life insurance to the next session, citing the need for further clarification. The Council has directed the Group of Ministers (GoM) to provide additional details to make their report more thorough.

The Council said that the matter requires further analysis and detailed examination before any decisions are made on revising the GST rates or reducing premiums related to health and life insurance.

[ad_2]