With sales of cars like the Maruti Alto, S-Presso and Celerio seeing year-on-year declines, Maruti Suzuki is looking to introduce a new entry-level car, and explore a mix of powertrain options for it. Along with a factory-fit CNG kit – now seen on nearly every Maruti Suzuki car – the brand is exploring mild-hybrid and flex-fuel powertrain options for the new entry-level small car. Based on parent company Suzuki’s Mid-term Management Plan, the Japanese carmaker aims to regain its 50 percent market share in India by the end of this decade with the aid of the new small car.

New Maruti entry-level car

Targeting first-time buyers, those earning Rs 5-13 lakh annually

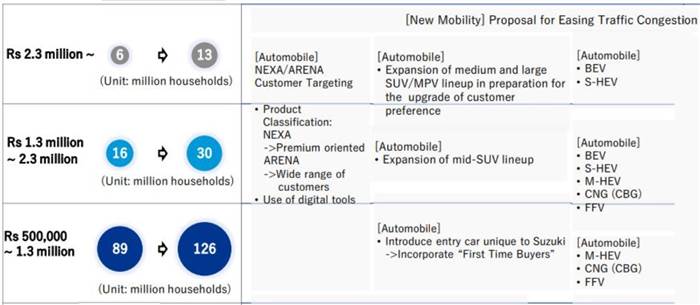

The Management Plan shows a product strategy for the Indian car market that includes “rapidly develop and introduce entry segment products that meet the preferences of entry-model customers”. The plan highlighted the introduction of a unique entry-level car as part of its strategy to serve Indian consumers that earn Rs 5-13 lakh annually, and attract more first-time buyers. As mentioned above, the new small car will be offered with CNG, flex-fuel and mild-hybrid powertrain options.

Do note, that this is new small car is completely distinct from the low-cost EV that Maruti has plans to bring to India. Based on the mid-term plan, both, the new Tiago EV rival and the new entry-level ICE model, are expected to arrive before FY2031.

Small car sales decrease in India affected Maruti market share

India’s passenger vehicle market is undergoing a slow growth phase due to a high base effect and sustained weakness in the small car segment. The slowdown reflects de-growth in the entry-level or small hatchback segment, which has been the segment that attracts many first-time buyers from the two-wheeler market.

Suzuki president Toshihiro Suzuki recently said, “Small car sales are declining, but they will settle. When we look at Maruti Suzuki’s small car sales, they are comparable to the SUVs currently being sold by other manufacturers. I don’t think the small car will cease to exist. As there are still 1 billion people who are yet to shift from a two-wheeler to a new car, they would need a four-wheel good car in the small car segment.”

While demand for SUVs continues with modest growth in passenger vehicle sales, the small and affordable car segment continues its downward trend. Even with a car penetration level of only 34 per 1,000 people in India, the share of first-time buyers in the industry has come down to approximately 40 percent.

Maruti Suzuki’s management has continuously voiced the need to revive the small and affordable car segment for sustainable growth in the passenger vehicle industry. The automaker has seen its market share decline to around 41 percent, primarily due to weakness in the small car market, which has been its stronghold. Though Maruti Suzuki has launched a decent share of the SUV market recently, growth in the small cars market is crucial for the automaker to regain its 50 percent market share.

Small car sales decline due to increase in costs

Buyers in the entry-level car segment are susceptible to acquisition and running costs. Substantial increases in the price of these cars over the years have been disproportionate to the rise in income levels for the buyers in this category post the BS6 emission and safety norms.

Buyers want affordable small cars with higher fuel efficiency

In a recent interaction with our sister publication Autocar Professional, Maruti Suzuki Chairman RC Bhargava said the overall growth of the passenger vehicle industry can be robust only if small cars generate demand. “We will continue to make as many small cars as the market can pick up,” he said.

Bhargava mentioned that affordable cars with higher fuel efficiency are needed to make them more attractive to consumers in the segment, especially those upgrading from two-wheelers. “We need an affordable car that drives 30-40 kilometres on a litre of fuel,” he said.

Most affordable Maruti cars on sale

Currently, the Maruti Alto K10 is the most affordable model in the brand’s portfolio, with a starting ex-showroom price of Rs 4.09 lakh, followed by the S-Presso at Rs 4.27 lakh. Most carmakers have exited the Rs sub-5 lakh car market, though Renault continues to offer the Kwid (starting at Rs 4.69 lakh).

All prices, ex-showroom, Delhi

Also see:

Maruti Ciaz to be phased out by April 2025