Credit: Giphy

Also in this letter:

■ Ola board approves acquisition of Avail Finance

■ PhableCare raises $25M, and other done deals

■ Startups, ecomm and IT firms drive deals in Q1 2022

Elon Musk turned down Twitter board seat, says CEO

Twitter’s chief executive Parag Agrawal said on Monday that Tesla founder Elon Musk has decided not to join the social media company’s board, days after he disclosed a 9.2% stake in the firm.

“We believed that having Elon as a fiduciary of the company where he, like all board members, has to act in the best interest of the company and all our shareholders, was the best path forward. The board offered him a seat,” Agrawal said in a tweet.

“Elon’s appointment to the board was to become officially effective [April 9], but Elon shared that same morning he will no longer be joining the board. I believe this is for the best,” he added.

Minutes after Agrawal’s tweet, Musk tweeted a chuckling emoji, leaving users confused. He later deleted the tweet.

After Musk disclosed his stake in Twitter on April 4, becoming its largest shareholder, Agrawal had tweeted that he was “excited” that the Tesla chief executive would join Twitter’s board.

Musk went on to propose modifications to the Twitter Blue premium subscription service on Saturday, including lowering the price, prohibiting advertising, and allowing users to pay in the cryptocurrency dogecoin. He had also tweeted a poll on whether Twitter should introduce an edit button last week.

Koo woos Musk: Hours after Agrawal announced that Musk had decided not to join Twitter’s board, Aprameya Radhakrishna, chief executive officer of Indian microblogging site Koo, asked the tech billionaire to join the board of his startup.

He tweeted: “We’re young, agile and dreaming big! Koo being built as the future of social media @kooindia. Your specific point on democratised verification [is] already done btw.”

On April 6, Koo announced that it had launched voluntary self-verification for all users, claiming it was the first social media platform in the world to do so.

This is not the first time Radhakrishna has reached out to Musk. Last month, he urged the Tesla chief executive officer to join Koo as a user.

Ola board approves acquisition of Avail Finance

The board of Ola’s parent company ANI Technologies has approved the acquisition of Avail Finance, people briefed on the matter told us.

Related-party transaction: Ankush Aggarwal, cofounder of Avail Finance, is the brother of Ola founder and CEO Bhavish Aggarwal. We had reported on March 25 that the deal would be considered a related-party transaction as both brothers are directors of Goddard Technical Solutions, which operates Avail Finance.

Ankush Aggarwal is expected to lead Ola Financial Services, Ola’s fintech arm, according to a source. We had reported in March that he would be primarily responsible for the lending business.

Ola had said last month that it would acquire Avail Finance in a $50 million share swap deal, subject to the board’s approval. We reported on the same day that Ankush Aggarwal and Avail Finance’s investors, including Alpha Wave Ventures and Matrix Partners, would get a stake in ANI Technologies after the acquisition.

Loans for drivers: Ola said acquisition of Avail Finance, which provides loans to blue-collar workers, would help it strengthen its play in the credit-underserved segment, which includes its driver partners.

Tweet of the day

ETtech Done Deals

■ PhableCare, a chronic disease management company, has raised $25 million in a funding round led by Kalaari Capital. The company said it would use the funds to further strengthen its ecosystem and accelerate its market expansion, acquire customers (doctors and patients), build its brand, and create new revenue streams.

■ Healthcare provider Medfin has raised $15 million in fresh funding from investors including Arka Nxt, HealthXCapital (Singapore), Blume Ventures, Axilor Ventures, Sony and Kotak Investments. The company offers patients access to the latest surgical treatment procedures at affordable prices. It said it will use the funding for geographical expansion, investing in R&D, technology, and hiring people.

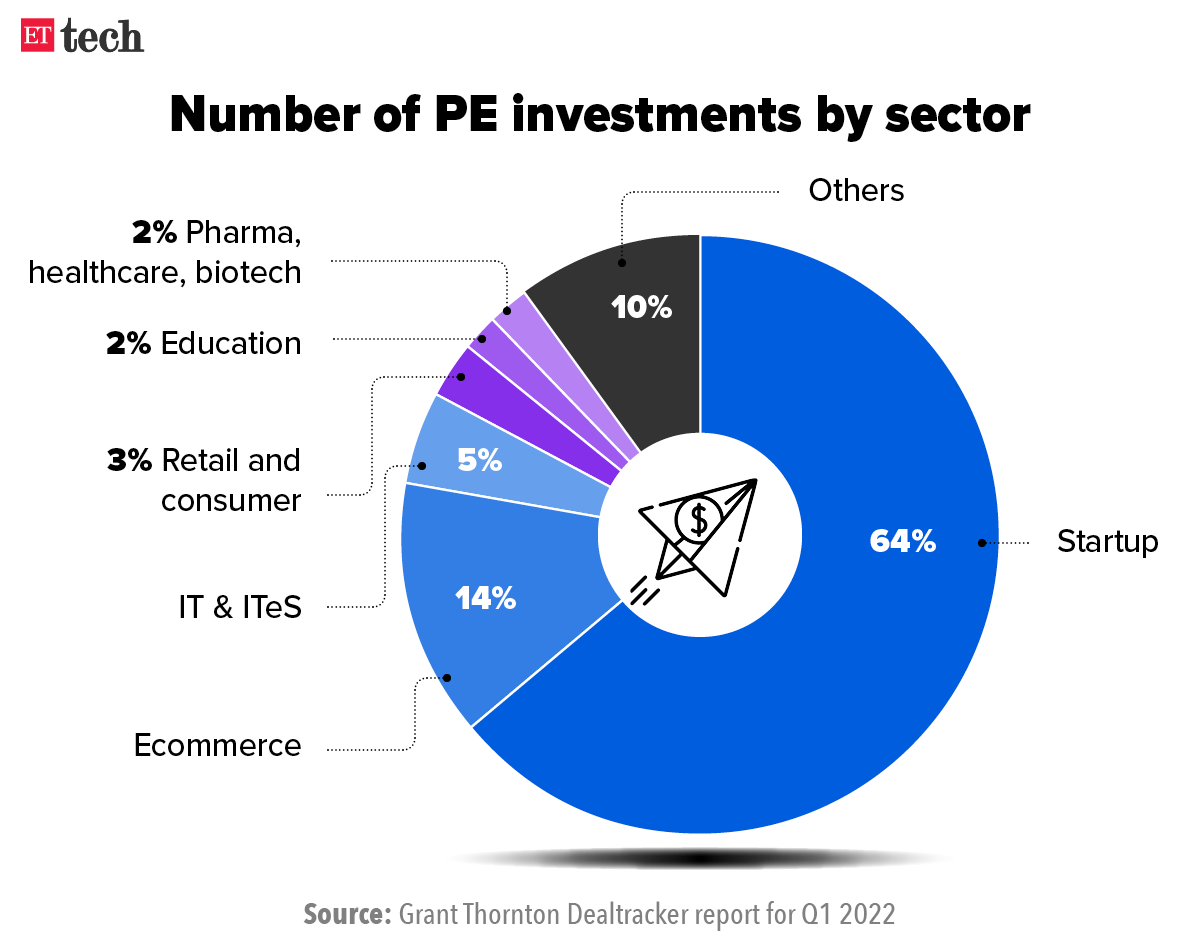

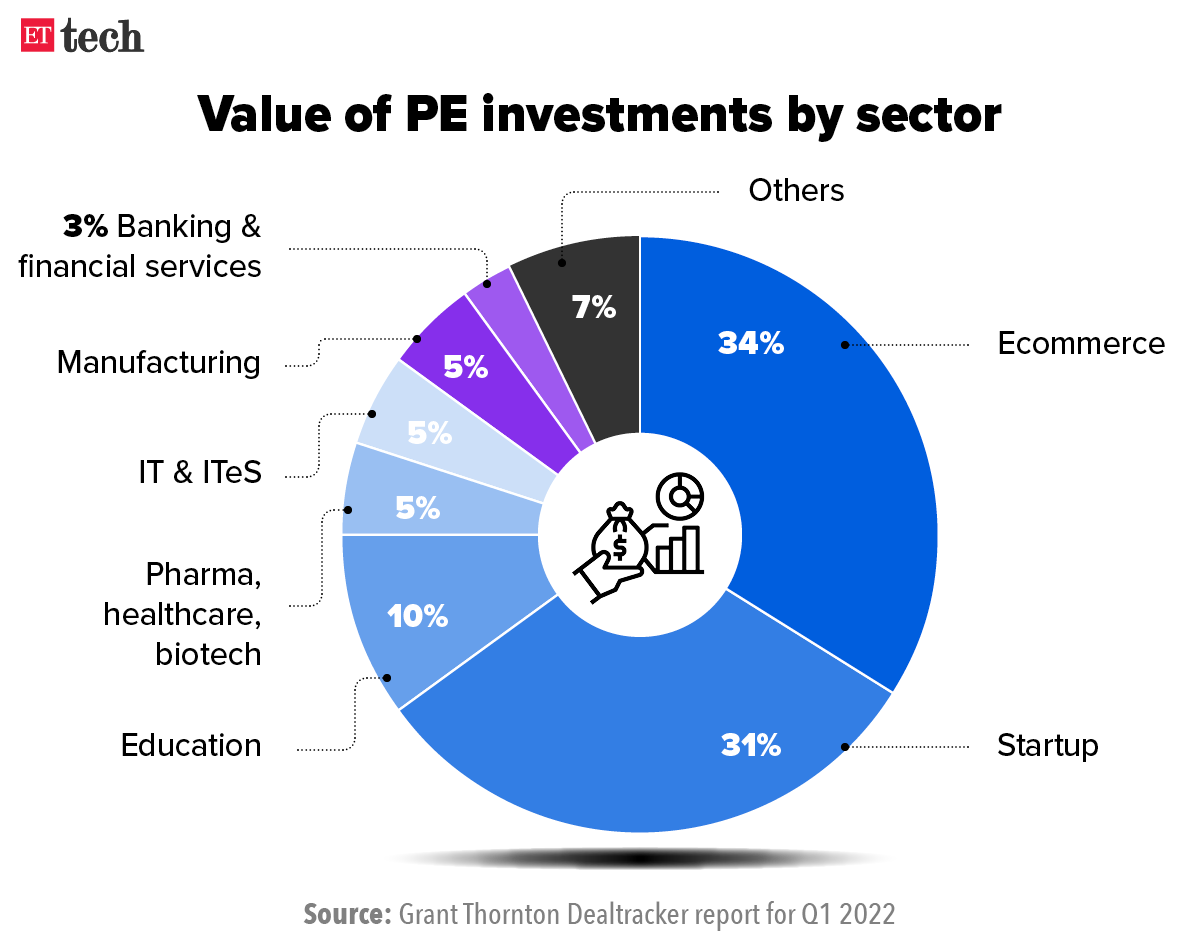

Startups, ecommerce and IT firms drive deal values in Q1 2022: report

Startups recorded the highest number of private equity deals and M&As, according to Grant Thornton Bharat’s Dealtracker report for January-March 2022.

Details: Twenty-five deals of over $100 million each, 99 deals valued at $10-99 million each, and an increased focus on startups helped the Indian private equity (PE) funding ecosystem post a 92% increase in investment value to $9.4 billion from $4.9 billion in the same period last year.

PE deals: Startups led on private equity investments in terms of number of deals, wrapping up 283 investments worth $2.9 billion in the quarter. Retail tech and fintech led investment volumes in the startup sector with 18% each.

M&As: The startup sector also continued to dominate M&A deal activity, with 58 deals valued at $567 million in the quarter. The IT sector saw 34 such deals worth a total of $825 million. Overall, the number of M&A deals jumped 53% from Q1 2021, driven by a 64% increase in domestic deal volumes.

Big deals: Byju’s $800-million fundraise was the largest deal recorded in the quarter, followed by Swiggy’s $700 million fundraise. Startups such as Zetwerk and Ola Electric Mobility also made it to the top 10 with deals worth $210 million and $200 million, respectively.

How Meta fumbled propaganda moderation during Russia’s invasion of Ukraine

Days after the March 9 bombing of a maternity and children’s hospital in the Ukrainian city of Mariupol, comments claiming the attack never happened began flooding Facebook and Instagram moderators.

Images of bloodied, heavily pregnant women fleeing through the rubble, their hands cradling their bellies, sparked immediate outrage worldwide.

Among the most recognised women was Mariana Vishegirskaya, a Ukrainian fashion and beauty influencer. Photos of her navigating down a hospital stairwell in polka-dot pajamas circulated widely after the attack, captured by an Associated Press photographer.

But Russian officialdom seized on the images, setting them side-by-side against her glossy Instagram photos in an effort to persuade viewers that the attack had been faked.

How much can moderators do? “The posts were vile,” and appeared to be orchestrated, the moderator told Reuters. But many were within the company’s rules, the person said, because they did not directly mention the attack. “I couldn’t do anything about them,” the moderator added.

Quote: “We have separate, expert teams and outside partners that review misinformation and inauthentic behaviour and we have been applying our policies to counter that activity forcefully throughout the war,” Meta said in a statement.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi, Aishwarya Dabhade and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.