Also in this letter:

■ Analysts advise caution as new-age stocks continue to plummet

■ Worldwide tech slump may hit IIT placements

■ Heady hikes for tech job switches seem to be over

Why Ecom Express trails rivals in logistics industry’s game of thrones

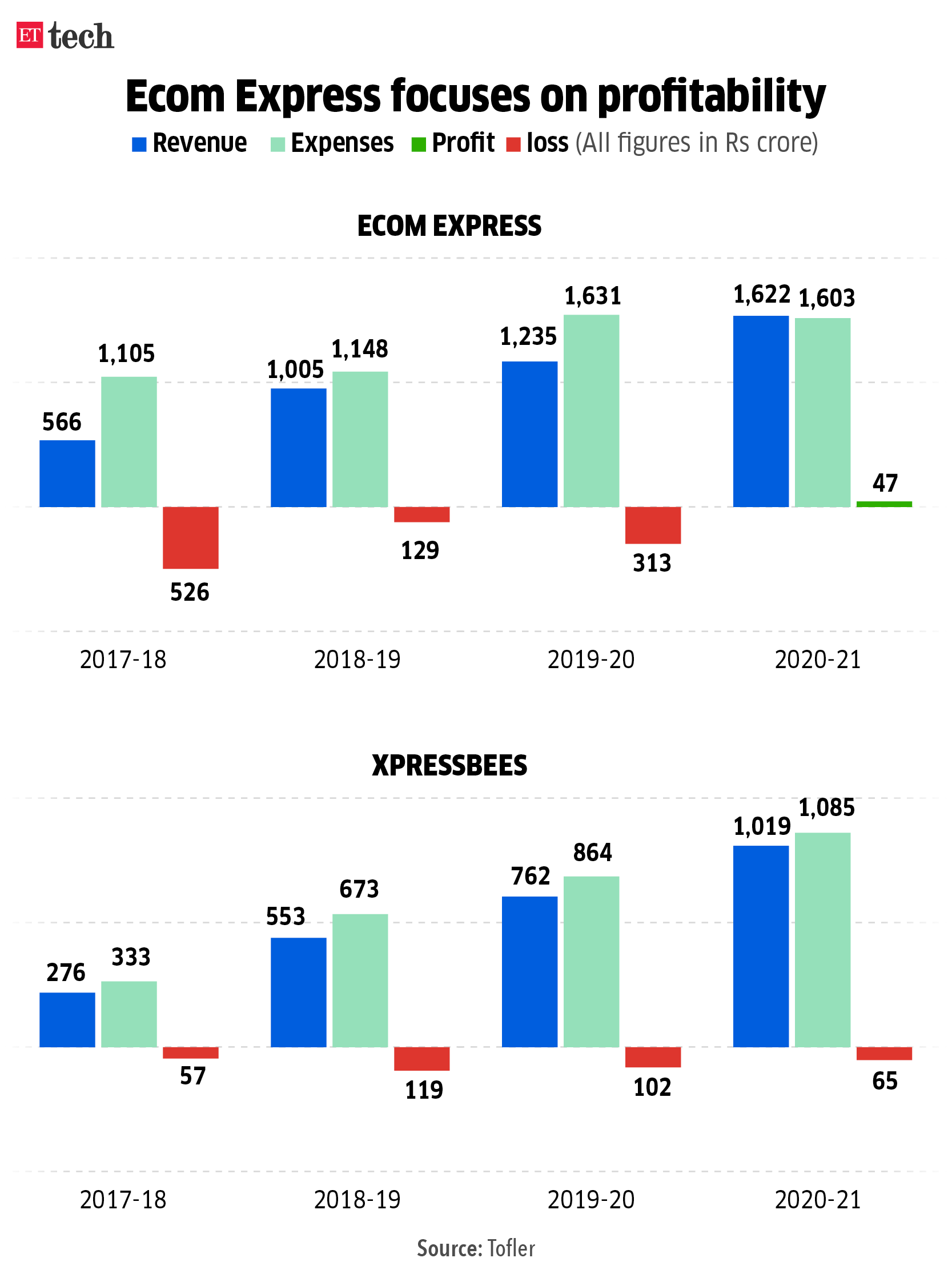

Ecom Express isn’t your average new-age company, chasing growth at all costs.

Indeed, the third-party ecommerce logistics player, for long the number-two in its segment, has now been pushed to the third spot, multiple industry sources told us.

Despite this, the company continues to concentrate solely on ecommerce orders. Its rivals, meanwhile, have been casting a wider net and shoring up their market share.

For Ecom Express, the goal is sustainable profitability rather than the pursuit of volumes. But that approach may not be enough, given the numerous challenges the company faces in a sector that has turned into a veritable battleground.

Pecking order changes: A change has taken place in the top rungs of the third-party ecommerce logistics industry.

Pune-based Xpressbees has been surpassing Gurugram-based Ecom Express on daily order volumes for a few months now, especially in the first quarter of this financial year, according to multiple sources aware of the numbers. Xpressbees has been scaling its operations and adding to its core ecommerce delivery offerings.

Challenges: Ecom Express has been facing its own set of challenges, having postponed its IPO plans and seeking to raise funds amid a slowdown in big deals.

The abrupt exit of Singapore’s Shopee from India in March was another major blow for Ecom Express, as it handled the most volumes for the Southeast Asian ecommerce firm, our sources said.

Why it’s losing ground: According to multiple industry executives and analysts we spoke to, the lack of diversification beyond ecommerce and the pursuit of profitability rather than volumes could be why Ecom Express has fallen below Xpessbees in daily shipments.

“The company is not as aggressive as Delhivery and Xpressbees on the ground in terms of attracting business,” said a person who has worked across multiple ecommerce logistics companies.

The company has also faced tough competition from rivals on technology solutions. Ecom Express is seen as being slightly behind Delhivery and Xpressbees in terms of technology.

Analysts advise caution as new-age stocks continue to plummet

The rout in India’s new-age businesses deepened on Tuesday, led by a steep fall in One97 Communications, parent firm Paytm, and FSN E-Commerce Ventures, owner of Nykaa.

Large funds continued to dump their shareholdings in some of these companies, pointing to more pain ahead, said analysts, who warned retail investors against mopping up these shares at this juncture.

Tuesday rout: Paytm fell nearly 12% to touch new lows of Rs 474.30 apiece before closing the day at Rs 475.55 on the NSE. Shares opened lower and selling intensified after analysts at Macquarie said the entry of Reliance Jio’s financial services arm could pose a real threat to fintech companies and other non-bank lenders.

This rout dragged Paytm’s market capitalisation below $4 billion — the valuation at which it raised money from Alibaba and Ant Financial in 2015.

Reliance Industries said last month it is creating a financial services unit to focus on consumer businesses. Jio Financial Services will be demerged and listed as a separate entity.

Lock-in expiry blues: On November 15, the one-year lock-in on about 86% of Paytm’s outstanding shares expired. Following this, one of its early investors — SoftBank Group — sold 29 million shares through a block deal on Thursday for about Rs 1,631 crore or Rs 555.67 each.

Stocks of other listed new-age companies have also been battered after their lock-in periods expired. Nykaa’s stock fell 4.66% after Lighthouse India sold Nykaa shares worth Rs 355 crore via a block deal on Tuesday. TPG Capital sold shares worth Rs 1,000 crore last week, as did NRI investor Mala Gopal Gaonkar.

Also Read | Nykaa’s chief financial officer Arvind Agarwal resigns

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Worldwide tech slump may hit IIT placements

Indian Institutes of Technology (IITs) are likely to feel the heat of the global technology slowdown, even though they will be more insulated than many other engineering colleges.

Offers may dip: As Big Tech downsizes and the IT services sector goes through a hiring pullback, sources at IITs told us they were anticipating a dip in the number of both big-ticket international offers and IT recruiters on campus during final placements.

This comes after a record placement season for the Batch of 2022 at IITs — fuelled by pandemic-led digitisation and post-Covid revival in hiring — with an unprecedented number of crore-plus packages, international postings and other job offers.

Final placements at old IITs start on December 1.

Quote: “We are a little concerned, though the overall situation is definitely better than the Covid year. There is a small dip in the number of companies who have come so far,” said Sathyan Subbiah, a professor and placements adviser at IIT-Madras.

TWEET OF THE DAY

Heady hikes for tech job switches seem to be over

The party is almost over for tech workers in India, who commanded more than 100% increments for job switches just a year ago, recruitment service providers said, though switching jobs still fetches a 30-35% salary hike.

Macroeconomic pressures coupled with back-to-back tech layoffs and looming global recession have put a brake on the race for tech talent in the country, they told us.

By the numbers: This trend is validated by data shared exclusively with us by recruitment and staffing firm CIEL HR Services, which mapped increments handed out for job switches across 62 midsize to large IT companies in the past five months.

Average hikes for new jobs fell from 54% in July and August 2022 to 45% in September and 37% in October, the survey showed. It is now settled at 35% and is likely to further come down, said Aditya Mishra, chief executive of CIEL HR Services.

Comedown: According to experts, in 2021, or the year of the ‘great resignation’, candidates were offered huge hikes in salary, sometimes above 100%, when changing jobs. Then, tech talent had multiple offers in hand and were calling the shots, as we previously reported.

Govt panel remains divided on GST for online gaming

The group of ministers (GoM) set up to decide the Goods and Services Tax (GST) on online gaming, horse racing and casinos could not reach a consensus on the issue on Tuesday.

Divided: While most of the members of the GoM backed a uniform 28% GST on online gaming, finance ministers of Uttar Pradesh and West Bengal said ‘games of skill’ and ‘games of chance’ should be treated differently, people with direct knowledge of the deliberations told us.

The GoM also remained divided on whether to levy tax on just the gross gaming revenue (GGR) or the overall gaming proceeds.

The GoM met virtually on Tuesday to finalise its report, which is likely to include recommendations from the law committee and comments of opposing members. The GST Council is likely to meet this weekend.

Catch up quick: In its earlier report, submitted to the council in June, the GoM suggested a 28% GST on the full value of consideration, including the contest entry fee, paid by the player, without making a distinction such as between the games of skill and games of chance.

But following a request from Goa, the council had asked the GoM to reconsider its report and examine the possibility of treating games of skill and games of chance differently.

Other Top Stories By Our Reporters

SaaS firms lean on core business to ride out US market storm: India-based SaaS companies look to ride out the macroeconomic headwinds with judicious spending and sharper focus on core businesses as a recession in the US hits one of the country’s newest technology ecosystems in the form of slower business growth, entrepreneurs said.

Schneider Electric to make India its AI hub: Schneider Electric has said that it will make India the AI hub for its global business as it looks to consolidate and drive its AI-led solutions from one centre. Peter Weckesser, chief digital officer of Schneider Electric, said about 40% of his team was currently in India, and this number would only go up over time.

AWS launches second infrastructure region in Hyderabad: Amazon Web Services (AWS) on Tuesday launched its second AWS infrastructure region in Hyderabad, calling it the AWS Asia Pacific (Hyderabad) Region. AWS plans to invest about $4.4 billion (Rs 36,300 crore) in India by 2030 through this new region, including capital expenditure on construction of data centres, operational expenses of the ongoing utilities and facility costs, and purchases of goods and services from regional businesses.

Global Picks We Are Reading

■ Indian tech firms should think twice about layoffs (Rest of World)

■ Meta Quest Pro review: get me out of here (The Verge)

■ What to expect as FTX debuts biggest crypto chapter 11 in court (WSJ)