As the Income Tax Department continues to simplify the return-filing process, pre-filled ITR forms for Assessment Year 2025 have become a major convenience for taxpayers. However, despite the automation, several errors in pre-filled fields have been reported this year—potentially leading to faulty filings, penalties, or notices.

If you’re preparing your ITR for FY 2024–25, it’s crucial to manually verify each field before final submission.

Table of Contents

🔍 What is a Pre-Filled ITR?

Pre-filled Income Tax Returns (ITRs) are automatically populated forms that draw your financial data from sources like:

- Form 26AS

- Annual Information Statement (AIS)

- Taxpayer Information Summary (TIS)

- PAN-linked accounts and salary records

They include income from salary, interest from savings accounts or fixed deposits, tax-saving investments, and more. While this reduces manual entry, it also leaves room for data mismatches.

⚠️ Common Errors in Pre-Filled ITR Forms – AY 2025

Several taxpayers have reported the following recurring errors in their pre-filled ITR forms:

- Mismatch in Salary Figures

Salary details fetched from Form 16 may differ from actual income credited, often due to bonuses, variable pay, or last-minute payroll adjustments. - Incorrect or Incomplete Bank Account Details

Bank accounts used for refunds must be accurately reported. Outdated or inactive accounts often show up in the form. - Double Reporting of Interest Income

Interest from savings or FDs is often recorded both in Form 26AS and AIS, leading to duplicate entries. - Missing Capital Gains Data

If you’ve sold mutual funds, shares, or property, these gains may not reflect correctly—especially if reported late by financial institutions. - Inaccurate TDS Information

TDS may be credited under a different PAN (for joint accounts or partnerships), which can misalign the records. - Unreported Dividend Income

Several dividend incomes, especially those under ₹5,000, often go unreported or are not auto-filled correctly.

📝 Tips to Correct and File Your ITR Accurately

- Cross-verify all figures with original Form 16, bank statements, Form 26AS, AIS, and TIS.

- Edit pre-filled fields directly on the Income Tax e-filing portal if any mismatch is found.

- Declare missing incomes, especially those from dividends, rent, or freelance gigs.

- Use the ‘Recalculate’ option before final submission to check for errors.

- If you’re unsure, consult a certified tax professional or CA.

🗓️ Deadline Reminder for AY 2025

The last date to file your ITR without penalty is 31st July 2025. For businesses or audit cases, the deadline may differ. Keep an eye on official updates from incometax.gov.in.

⚖️ What Happens If You Submit With Errors?

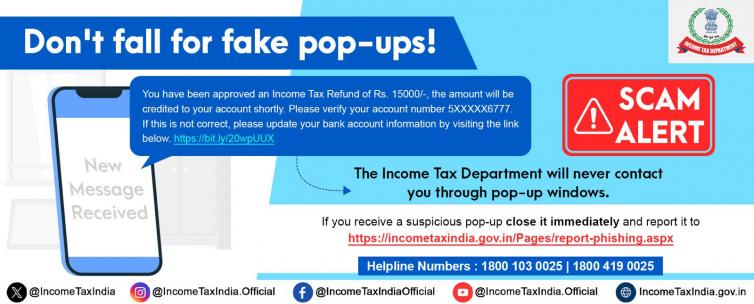

Errors—especially in income declarations or refund bank details—can trigger:

- Scrutiny notices

- Refund delays

- Penalties for inaccurate filing

Always ensure your ITR reflects accurate and complete information to avoid unnecessary complications.

🗣️ Join the Conversation

Have you spotted any mismatches in your pre-filled ITR this year?

💬 Share your experiences and help fellow taxpayers by commenting below!

❓ FAQs

Q1: What is a pre-filled ITR form?

A1: A pre-filled ITR form is an income tax return with pre-entered details sourced from PAN-linked data, Form 26AS, AIS, and TIS.

Q2: What are the most common errors in pre-filled ITR forms for AY 2025?

A2: Common errors include incorrect salary entries, duplicated interest income, unreported capital gains, and outdated bank details.

Q3: How can I correct errors in a pre-filled ITR form?

A3: Log in to the e-filing portal and manually review and update incorrect fields before submitting your return.

Q4: What is the last date to file ITR for FY 2024-25?

A4: The due date is 31st July 2025, unless officially extended by the tax department.

Q5: Can ITR errors lead to notices or penalties?

A5: Yes. Errors can lead to income mismatch notices or delayed refunds. Always validate before submission.